As Politan Prevails, Board Chairman Joe Kiani Loses His Board Seat & Maybe More

It was a long bloody battle and the outcome was less predictable this time around, due to allegations of vote manipulation and a high intensity – if often misguided – vigorous defense put on by Masimo CEO Joe Kiani and his management team. But now we know the result – Masimo shareholders voted in both of the Politan-backed candidates for nomination to the Board in a sweeping win for activist investor Quentin Koffey and Politan Capital Management. Chairman Joe Kiani, on the other hand, lost his Board seat.

See more about the big changes coming to Masimo thanks to the win by Koffey and Politan

Masimo investors have spoken – change is coming to Masimo! It came down to the wire, and no one was really sure how the vote was going to turn out. Even Politan, I suspect, was nervous that the vote would not go its way, as evidenced by the fact that it revealed a new lawsuit against the Masimo Board, Joe Kiani, and RTW Investments over what the activist investor said were signs of “empty voting,” an illicit scheme to artificially increase votes that would disenfranchise investors.

There also was a long and painful proxy battle, in which both sides emerged bruised and bloodied. Masimo failed to win a Preliminary Injunction and was accused of conspiring to steal the vote, and Politan was hit with a Contempt of Court finding by the judge which cast a shadow over the investor’s ethics.

Investors Remained Firmly Behind Koffey and Politan

But in the end, investors remained firmly behind the activist investor who promised to bring changes to Masimo that will improve its performance and stimulate a more meaningful resurgence in the company’s results. All of these things hold the promise of driving up stock value, which is music to investors’ ears. And with a truly independent and more balanced Board – hope is established for better decisions moving forward.

While each of us is independent and brings our own unique perspectives, we are united in our enthusiasm for Masimo’s future as a leading, innovation-focused growth company. We look forward to meeting with, learning from, and working together with the Healthcare and Consumer employees to make Masimo an even greater company. We would also like customers to know that we will be completely focused on preventing any disruption to their service and support. We will have more to share soon.

Joint statement of Darlene Solomon, William Jellison, Michelle Brennan, and Quentin Koffey

What Did Wall Street Think?

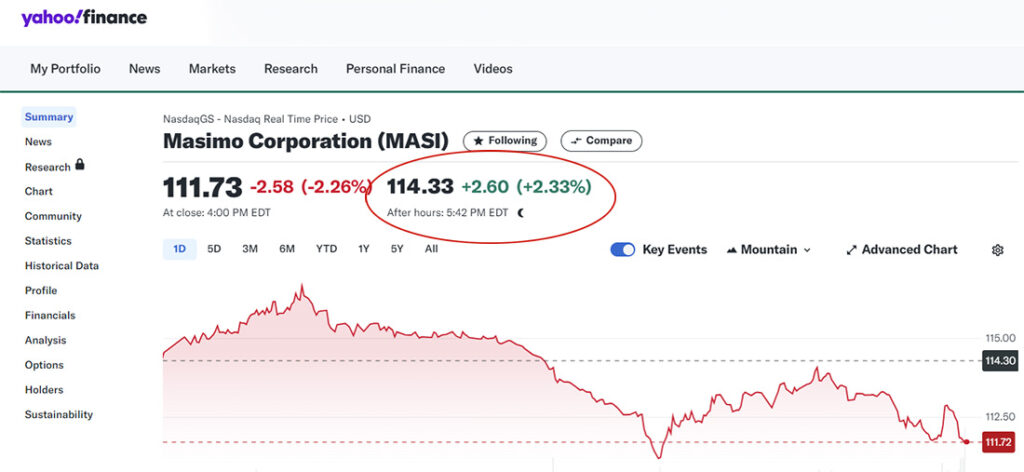

How did the market react? It was a down day for the Nasdaq on Thursday. Shares in Masimo stock were down $2.58 per share or -2.26%. But after the announcement late in the day of Politan’s candidates being elected, in after-hours trading, shares in MASI erased those losses, rising a solid +2.33% – a certain thumbs up by investors.

According to reporting by financial network CNBC, the Politan nominees “received roughly twice as many votes as [CEO Joe] Kiani and [nominee Chris] Chavez. CNBC said its source for this information was “a person familiar with the matter who requested anonymity to discuss non-public information freely.”

No Word from Masimo Management Yet

There has been no statement on the results from the company yet, but this is surely a demoralizing defeat for CEO Joe Kiani. In a recent Fortune article, Kiani said if he loses this vote, he will leave the company. And in a letter to the Board of Directors, Chief Operating Officer Bilal Muhsin said he intends to resign his position if Joe Kiani is removed as Chairman and CEO.

Finally, I must remind Strata-gee readers that this result almost certainly means that the future of Sound United as part of Masimo will be short indeed. From the beginning, Quentin Koffey has let it be known that he considers the decision by the Kiani and the legacy Board to acquire Sound United in 2022 as a huge mistake which has resulted in a nearly 40% market devaluation of the company that bedevils it to this day.

Instead of Considering Investors’ Feelings, Kiani Felt They Should Just Trust His Genius

It was Kiani’s lack of consideration for investors’ feelings on this issue that served to sow the seeds of discontent that grew into Koffey’s opportunity and ultimately led to this outcome. When you are a public company, you have a fiduciary duty to do all you can to increase shareholder value. However it appeared that Kiani felt that Masimo was his company and investors should just trust his genius to create future success. The more he talked about himself, the more investor gravitated towards Koffey and Politan.

At the end of the day, investors gave Kiani two years to show progress with his plan for Sound United and got tired of waiting for it to happen.

Learn more about Masimo at masimo.com.

Ted, ethically I’m not too worried about contempt when the items in question should never have been sealed in the first place. I’ve been following the California case on PACER.

I’ve been working on an acquisition with a client and I’m sure I asked harder questions than Masimo did when they acquired Sound United.

The question now is how to get rid of Sound United. Is there somebody out there that needs Masimo technology and is generally gullible when it comes to acquisitions? Yes, there is Apple.

Hi Steve,

I think the issue of Koffey/Politan’s Contempt of Court finding was actually a calculated risk on the part by Koffey who was WAY anxious to get this meaningful news out to investors who are all in the moment of deciding who to vote for. True, he should have either waited for the judge to publish his final decision (the order was in fact sealed at that point), or have reached out to the judge for permission to make a limited release of the order. But as you noted Koffey took pains to keep confidential inforamation out of it. Politan may get a monetary penalty, but I would not expect it to be too outrageous.

According to Masimo, there have been several parties who have reached out in connection to the Sound United business. I have no idea who, but they have a starting point for some type of possible deal.

As far as Apple – it most likely would be interested in buying the Healthcare side of the business, as they would then own the pulse oximetry patents which would allow them to start selling Apple Watches with the technology included again.

Thanks for your thoughts!

Ted