Wow! It’s crazy that 2023 is now just about behind us, and what a dramatic and dynamic year it was! What were the key themes of the year? At the beginning of the year, I think most would say their greatest concern was the economy and their least concern was the tech industry. Yet the year turned out to be almost the exact opposite of that.

See more on the themes that were key in ’23 on Strata-gee

In looking back over 2023, I have identified several major themes that emerged as key in 2023 on Strata-gee. Below are a few of them in no particular order…

But first, any discussion of 2023 must include commentary on the economy and its fluctuation over the year. It is an inscrutable economy – which makes even economists look silly sometimes – and it continues with its mysterious ways.

Inflation is Hurting the Economy…Or Is It?

At the start of the year, a majority of economists were predicting a recession in mid- to late-2023. They were wrong, and a recession eluded us (thankfully)! In fact, consumer spending, job growth, and other key metrics defined a strong year economically.

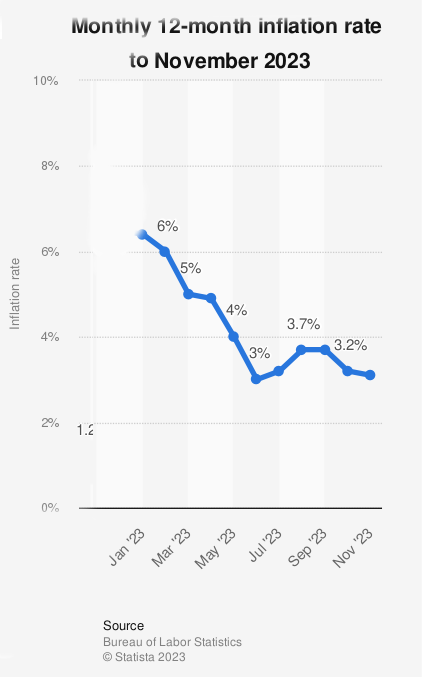

Yes, inflation was a bugaboo, but 2023 even tamed that! At the beginning of 2023, inflation was at 6.4%. By November (the last reading we have at the moment) inflation has dropped all year long and now at 3.1%, it is within spittin’ distance of the Fed’s target rate of 2%. In fact, the Fed is planning a schedule of interest rate CUTS in 2024 as inflation appears tamed.

- Example post: As Inflation Slides, Consumer Confidence Soars

A Soft Landing May Be At Hand

A recent survey said that 25% of Americans still believe that there will be a recession in 2024. Yet it is increasingly looking like we may have the U.S.’s first-ever “soft landing” – the elusive unicorn of economic stability.

Example post: May Inflation Rate Raises Hope for a ‘Soft Landing’; Fed Keeps Current Interest Rate

Tech Stumbles

In the meantime, tech stumbled a bit in 2023, starting with major layoffs at the big tech players like Microsoft, Google, Amazon, and more. Industry players, such as Snap One, Premium Audio Company (VOXX, Int’l), Sonos – all of whom had their own layoffs – as well as others reported a dramatic drop-off in consumer demand as the down cycle of the post-pandemic period began to take traction.

- Example post: More Tech Layoffs are Revealed as Google Cuts 12,000 Jobs

- Example post: Sources – Snap One has Restructured Operations with Staff Layoffs

An Amazing Year for Strata-gee

For Strata-gee, 2023 was amazing! After years of consistent and methodical growth in our reader base, something happened at the end of 2021…something remarkable. All of a sudden, our subscriptions started growing at an increasing pace. That accelerating rate of growth continued throughout all of 2022 and by the end of September 2023, our reader base was between 2-to-2½ TIMES larger than it was at the end of 2021! Holy cow!!

Thank you, thank you, thank you to all of our new readers!!

Specialty Audio Interest Remains High

The data are clear – the interest in specialty audio is quite high on Strata-gee. Not only do these stories consistently draw high pageviews (the metric most content creators use to gauge interest), but one of our top stories this year was Audio Research Corporation Files Court Docs to Enter Form of Receivership… just one of many specialty audio stories. And, I might add, it was a specialty audio story with pageview numbers so sky-high, that I get a nosebleed just looking at it!

While I consider the specialty high-performance audio segment as one of my “beats” for coverage, the pageview numbers these posts are drawing continue to surprise me.

Goodbye Supply Chain Issues…Hello ‘Destocking’ Issues

Certainly one of the greatest lessons we learned from the global pandemic was that our supply chain was incredibly fragile…and, ultimately, broken. And while the pandemic forced consumers to shelter in their homes 24/7 for some time, causing demand to skyrocket for home entertainment, home networking, and home office technology, the supply chain shortages killed our ability to fulfill that demand.

Now, thankfully, in 2023 we began to see the supply chain deliver again. But then a new problem emerged that added a new word to our vocabulary – destocking. What happened is that many integrators who kept ordering more and more goods that they couldn’t get because of backorders suddenly received a shipment with all of their open backorders shipped at once.

More than one integrator told me that they were forced to get a bank loan to take in all of these goods – in many cases, a year or more worth of inventory. Then, month after month, they pulled from their inventory to complete their installations. But what they didn’t do was order more goods from major suppliers.

And this, my friends, is destocking.

Complicating the situation is that many markets saw a drop-off in consumer demand and while there was still business to be had, the level of business had clearly declined.

- Example post: Snap One Fiscal ’23 Q3 Shows Recurring Story of Sales Declines While Losses Improve (Scroll to the Comments at the bottom to see two integrators who shared their destocking stories)

More Davids Take on More Goliaths

Some of the most popular Strata-gee stories this year were my coverage of the litigation efforts of mid-sized industry companies taking on some of the giants of tech. The two most prominent examples of this trend are Masimo vs. Apple, and Sonos vs. Google.

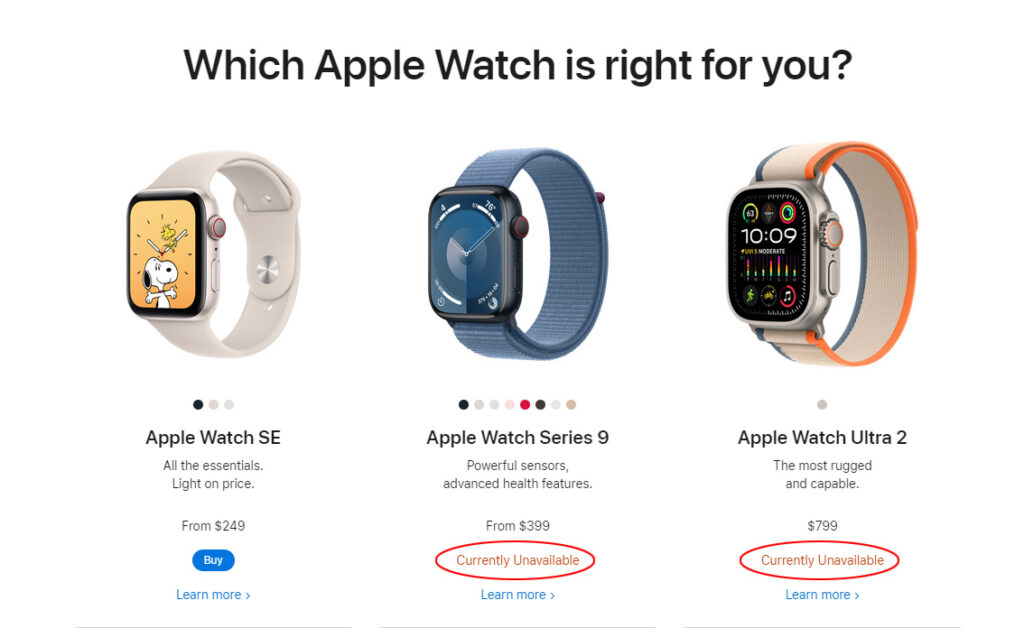

And while both of these cases have been going on for a while, Masimo v. Apple was thrust into the spotlight recently, when Apple was forced to take a couple of its newest Watch models off the market for infringing on Masimo patents. On Wednesday, Apple has won a brief reprieve in the form of a temporary stay of the ban until the court can hear arguments.

- Example post: Apple Watch Ban Takes Effect as White House Declines to Veto USITC Action

- Example post: After $32.5 M Jury Win for Sonos, Judge Throws Out Jury Verdict and Finds for Google

Major Buying Group Player Nationwide Launches Bold Initiative to Capture 1,000 CI Members

In what has to be one of the boldest moves I’ve ever seen from the buying group segment, Nationwide Marketing Group unveiled a clever and seemingly strategically sound plan to capture the dominant position in custom integration dealer buying groups with its “Drive to 1,000” member initiative. Central to their plan, expand the pool of integrators who sign up to join a buying group, actively engage in helping drive their success, and offer them a cradle-to-grave solution.

I’ve covered this initiative since it first launched, and so far the progress has been impressive. But group executives assure me that they are in this for the long game, no matter how long it takes to succeed.

- Example post: HTSN Become Oasys, Welcomes an Expanded Class of Dealers as Part of Nationwide’s ‘Drive to 1,000’

- Example post: With Oasys Growing 100%, the Nationwide ‘Drive to 1,000’ is a Short One

Mini AVRs are a Thing

I don’t know, maybe sometimes even I have to “see it to believe it,” but CEDIA Expo 2023 made a believer out of me by proving that small form-factor audio-video receivers (Mini AVRs) are a thing. I found a lot to like at Expo, but one of my top stories was the growing pool of Mini AVRs, which were shown by AudioControl, Russound, and Snap One.

Manufacturers tell me that integrators are clamoring for the small form-factor items as more and more clients are asking for upgraded audio in secondary and tertiary rooms. Some of these versions can literally be mounted behind the TV for an out-of-sight audio enhancement that is Outta_sight!

On to 2024!

So that’s a wrap on 2023! There were other stories I reported in 2023, some of which were also important in their own way. But, in my mind, these were the top themes.

What do you think? Did I miss something? Share your top stories of 2023 in the Comments section below. I’ll see you next year!

Leave a Reply