Although the US is in the midst of a record period of economic expansion, more and more troubling signs have appeared over the last few months in the form of negative economic data points to suggest that a turn in the economy may be coming. This week, a trio of new reports – consumer confidence, sales of newly constructed homes, and corporate earnings revisions – suggest that economic growth is stalling and that “turn” may be here.

See the latest economic data suggesting a slowdown…

Isaac Newton once famously said, “What goes up must come down.” While he wasn’t referring to economic growth, he might just as well have been, as experts will tell you it is an inescapable truth that economies run in cycles of ups and downs. So the US economy has been expanding for more than 10- years now – a new record – this reality is leading experts to watch closely for signs of an almost certainly approaching downturn.

Three new economic reports suggest such a turn may be coming. These reports are: the latest reading on consumer confidence, a downturn in sales of newly built residential homes, and a large number of companies revising their earnings estimates downward. It’s important to note that these three economic data points each represent different segments of the overall economy, including consumer, housing, and corporate profits.

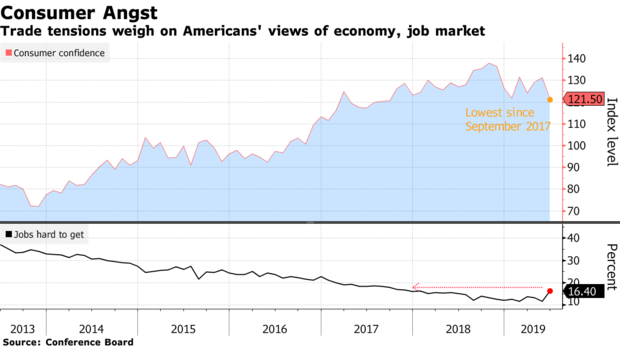

Consumer Confidence at Lowest Level Since 2017

There are two major organizations that regularly survey consumers on their sentiment, but the one most economists watch is conducted by the Conference Board and is known as the Consumer Confidence Index. The Conference Board announced last week that its Index dropped to a reading of 121.5 for the month of June.

According to Bloomberg News, this reading is lower than all forecasts from all economists they had surveyed in advance of the report. It is also the lowest reading on consumer confidence since September 2017. According to Bloomberg, “Americans became less upbeat about the economy and labor market amid trade tensions with China and Mexico.”

“The escalation in trade and tariff tensions earlier this month appears to have shaken consumers’ confidence. Although the index remains at a high level, continued uncertainty could result in further volatility in the index and, at some point, could even begin to diminish consumers’ confidence in the expansion.”

Lynn Franco, senior director of economic indicators at the Conference Board

Sales of Newly Built Residences

In new data from the US Department of Commerce, sales of newly built single-family homes in May were at a seasonally adjusted annual rate of 626,000. This rate is fully 7.8% below the revised rate in April of 679,000 – and it is the lowest level of sales for all of 2019. It is also 3.7% below the 650,000 rate of sales in May 2018.

On a regional basis, both the Midwest and South regions showed modest growth rates of +6.3% and +4.9% respectively over April. But the Northeast and West regions saw sales declines in the double-digits of -17.6% and -35.9% respectively.

The decline in sales means the inventory of unsold homes in terms of months supply increases by 8.5% from 5.9 months to 6.4 months. The median price of homes sold in May was $308,000, down from $335,100 in April.

Corporate Earnings Forecasts

Perhaps one of the more surprising reports was also from Bloomberg News. Under the headline, “Grim Earnings Forecasts Are Getting Worse by the Week,” Bloomberg notes that almost every day now corporations are revising their earnings estimates…more so than is typically the case.

Many public companies offer guidance to the market to help investors better understand their anticipated revenue and profit performance. It is a known phenomenon that just a few weeks before the official announcement is to come out – there is often a rash of announcements of corporations revising their estimates.

But, why is this a common practice? “It makes it easier to clear a lowered bar, when results are released,” Bloomberg helpfully explains.

However, recently the market has been virtually inundated with earnings forecast revisions. So much so that Bloomberg adds, “Right now, though, something more worrisome may be at work.”

“One of the things that investors seem to be overlooking is how poor the earnings environment is. We’re so focused on monetary policy and this mythical China deal that we just don’t seem to be paying attention to earnings, which are really what should be driving stock prices.

David Spika, president of GuideStone Capital Management to Bloomberg News

What has Bloomberg and many economic experts concerned is that of the S&P 500 companies that have recently revised their profit estimates up or down heading to an impending announcement, more than 80% of them have “slashed” their estimates downward. This means that corporate profits are declining or decelerating…not a good sign for the direction of economic growth heading into an election year.

Leave a Reply