Onkyo, Integra, and Klipsch Owner Stops Bleeding in Profits But Not Sales

Voxx International Corporation (Nasdaq: VOXX) announced the financial results for its second quarter and first half of Fiscal 2025 on Thursday after the close of markets. The company, which is in the middle of a major transformation of its business, hailed the results in which it has dramatically cut the level of its total and net debt, and finished with a small net income after several quarters of net losses.

But these positive results were generated at the expense of net sales which continue to decline.

See more on the results of the second quarter for Voxx

For several quarters now, Voxx has made no bones about the fact that it is struggling to improve revenues in a difficult economic environment with high interest rates, high automobile costs, limited housing inventory, and lower consumer spending. Consequently, the company decided to embark on a restructuring of its business to cut overhead, offload “non-core” brands and assets, and pay down its debt which ballooned as a result of a negative decision by a court-ordered arbitrator.

‘Our Plan to Unlock Value’

Voxx CEO Pat Lavelle referred to these initiatives again in his discussion of their financial results. Lavelle noted that the company “…made significant progress…in executing our plan to unlock value.” They also, Lavelle said, “embarked on an internal restructuring plan to right size our business [a reference to significant layoffs] and improve operational efficiencies, while lowering expenses and our working capital needs.” He also noted that they “…looked to monetize non-core assets” such as selling off “…our domestic accessories business and two non-core premium audio brands netting approximately $28 million in the transactions.”

As a result, Lavelle noted, after exiting 2024 with “losses and…over $73 million in total debt which historically, is very high for us…” the company now finds its “total debt is less than $20 million and our net debt stands at under $15 million…”

Laser Focused on Getting Back to Profitability

Lavelle says the company is “…laser focused on getting VOXX back to profitability.”

We also embarked on a strategic alternatives process to explore all avenues that could generate better value for our shareholders given what we believe to be a significant disconnect in our asset value and stock price. This could mean a sale of our entire business, or additional business or asset divestitures as we still have significant value within our portfolio, as well as owned real estate. Irrespective of the outcome of the process, we are laser focused on getting VOXX back to profitability. Through restructuring programs, our OEM relocation, strong management of the supply chain, and all of our new programs and products, we believe we can do that this Fiscal year. We are aggressively taking actions and controlling what we can to offset anything the economy or business environment may throw at us. We’re well on our way to achieving our goals provided sales materialize in the second half of the year as planned.

Pat Lavelle, Voxx International Corporation Chief Executive Officer

A Deep Dive into the Numbers

So let’s dive into the numbers to see just what the company achieved in the second quarter of Fiscal 2025.

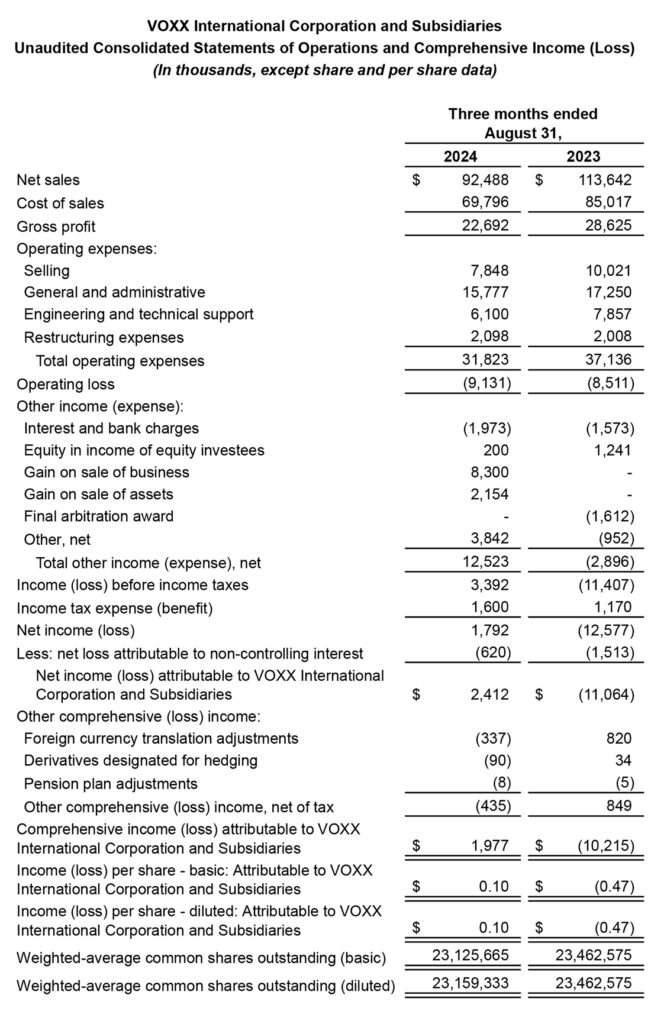

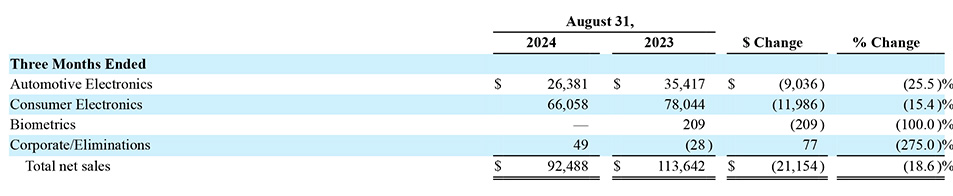

Net sales for Voxx in Q2 – the quarter that ended August 31, 2024, came in at $92.5 million, down $21.2 million or 18.6% as compared to net sales of $113.6 million in the same quarter in Fiscal 2024. The company has two major segments of business, the Automotive Electronics segment and the Consumer Electronics segment.

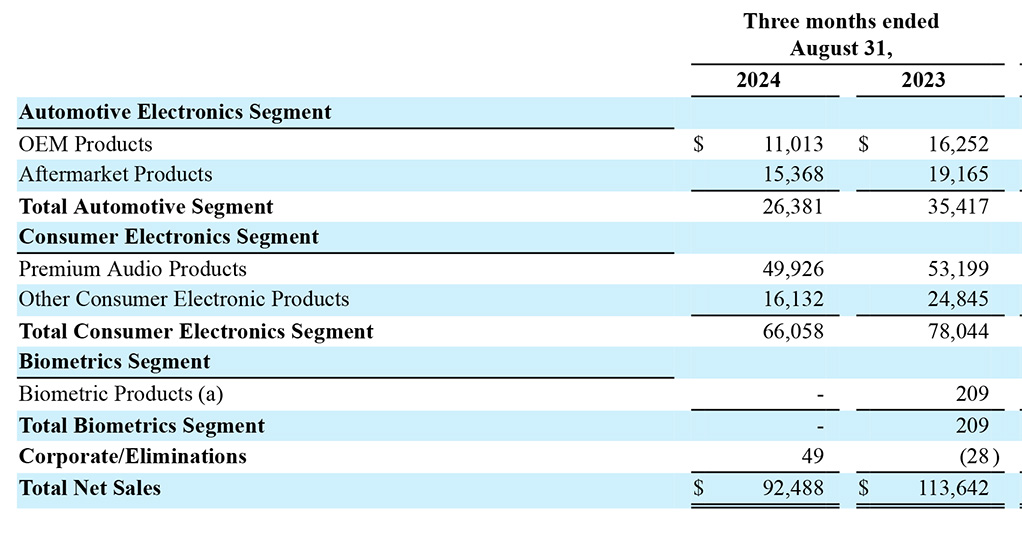

The Automotive Electronics segment’s net sales were $26.4 million, which was down $9.0 million or 25.5% in comparison to net sales of $35.4 million in the quarter last year. Both subsegments of this business, OEM product sales, and Aftermarket product sales declined. OEM declined due to lower sales of OEM rear-seat entertainment and remote start products. Aftermarket declined due to the market dealing with “inflated vehicle pricing and high interest rates,” which the company says has lowered consumer spending on vehicles.

In the Consumer Electronics segment, net sales came in at $66.1 million, which was a decline of $12.0 million or 15.4% compared to net sales of $78.0 million in the same quarter last year. Again, both subsegments of this segment, Premium Audio Products and Other Consumer Electronics registered net sales declines. Premium Audio Products net sales declined 6.2%, coming in at $49.9 million versus $53.2 million last year. The company said the declines in the category were due to “fewer close-out sales in the prior year, and lower consumer spending amid economic and geopolitical concerns…” Other Consumer Electronics products saw net sales collapse by over 35% with sales of $16.1 million versus net sales of $24.8 million last year. Voxx attributed this decline to “lower European accessory product sales.”

Gross Margins Also Declined

The company’s Gross Margin also declined, coming in at 24.5% as compared to 25.2% in the same quarter the previous year. This is a decline of 70 basis points, and the company explained this by looking at each of the separate segment’s gross margins.

In the case of Automotive Electronics, the gross margin declined 70 basis points largely due to the fact that its product sales mix has shifted to lower margin items. In the case of Consumer Electronics, the gross margin in this segment declined a more modest 40 basis points, which the company attributed to “the significant sales decline in the Company’s European accessories business, as well as the decline in premium audio sales in Europe and Asia.

Operating Expenses Improve

Where the company made up some ground was in reduced expenses, which helped to improve profits. This was a big point of the major restructuring the company went through with significant layoffs resulting in headcount reductions going forward.

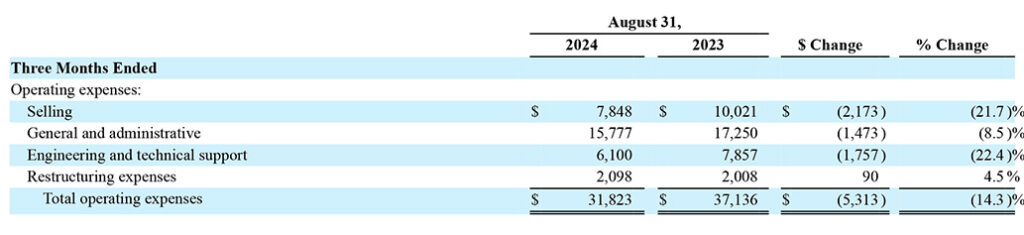

In Q2 Voxx reported Total Operating Expenses of $31.8 million which was $5.3 million or 14.3% lower than total operating expenses of $37.1 million in Q2 of Fiscal 2024. The company didn’t mince words, expenses were much lower due to “the positive impact from restructuring programs and other initiatives designed to lower costs and working capital needs.”

Selected Expense Category Results

Selling Expenses – Down 21.7% due to “lower advertising and website expenses, as well as lower headcount related expenses…”

General and Administrative Expenses – Down 8.5% as a result of “lower headcount related expenses, the absence of EyeLock LLC salaries and Mr. Kahli’s executive salary…”

Engineering and Technical Support Expenses – Down 22.4% due to “a decline in research and development expenses”…as well as “labor expense and related benefits declined as a direct result of the Company’s restructuring programs and its use of outside labor…”

Restructuring Expenses – However, one expense actually did increase. The company says that restructuring expenses increased to $2.1 million versus $2.0 million last year, mostly due to “severance expense related to Companywide headcount reductions…”

Other Income/Loss Items

Operating Income/Loss – Voxx did report an elevated Operating Loss of $9.1 million for Q2/FY2025 as compared to an operating loss of $8.5 last year.

Other Income, Net – Here the company was able to generate a significant increase in Other Income. Other income came in at $12.5 million compared to other income of $2.9 million in the quarter last year. That is a 331% increase and is largely attributed to the fact that the company sold off VOXX Accessories Corp business, a couple of its Premium Audio Company brands generating Other Income. This is only a partial of all the money they will garner from those sales, but they generated $8.3 million for a portion of the Accessories business and $2.2 million for the sale of PAC’s Jamo and Energy brands.

Net Income, Yes…I Said Income

After several quarters of generating Net Losses, Voxx reported that for Q2/FY2025, they generated a Net Income of $2.4 million. This is infinitely better than the net loss of $11.1 million the company generated in the same quarter last year.

Three Major Accomplishments

The company really had three major accomplishments in this quarter that contributed mightily both short term for this quarter, and will contribute more over the next quarter or two. Those three accomplishments are the sales of the domestic accessories business, the sale of two Premium Audio Company brands, and the sale of the company’s Orlando, FL OEM manufacturing business.

Let’s talk about those in a little more detail…

#1 – Sale of the Domestic Accessories Business Business

At the end of August, Voxx sold significant assets from its wholly-owned subsidiary, VOXX Accessories Corp (VAC). Those assets included intangible assets and inventory – which the company says is included in the Consumer Electronics segment. This was sold to Talisman Brands Inc., which is otherwise known as Established.

The business was sold for $24.5 million, which was recorded as a receivable due from Established. Voxx received an initial $8.3 million, which went towards Other Income for the Q2 and first half of Fiscal 2025. The company will receive another $24.4 million in the next quarter and small remaining balance the quarter after that.

The proceeds of this sale were used by the company to pay its outstanding debt.

#2 – Sale of Premium Audio Company Brands and Related Inventory

Voxx’s audio division, Premium Audio Company, sold off two “non-core” speaker brands – Jamo & Energy – to aid in the reformation of the company. Specifically, the company sold off the trade names and inventory to Jamo Holding Limited and Cinemaster Shanghai Ltd for a total of $3.4 million collectively. The company noted that it “recognized a gain of $2.2 million on the sale of these assets” that was accounted for in “Other income” in Q2 and first half results.

This $2.2 million appears to be the full value net of other expenses or debts, which seems pretty small for two brands of speakers. The company said it used these proceeds to “repay outstanding debts.”

The company has also revealed that it will no longer sell the Pioneer or Esoteric brands as well. Although they make it sound as though this was part of a strategy, the buzz on the street is that Pioneer pulled the license from them. This take, of course, is just a rumor.

#3 – Sale of Orlando, FL OEM Manufacturing Facility

In September, after the close of this quarter, the company announced it had completed the sale of its Orlando, FL OEM manufacturing facility as part of the process of moving those manufacturing functions to Mexico. This sale, the company said, was set at a purchase price of $20.0 million.

While selling this facility did not impact the Q2 earnings, the company – trying to emphasize positive events – chose to speak about it on the Q2 earnings call anyway. The reason is that they were able to take the net proceeds from this sale and apply it to the outstanding mortgage on the facility and otherwise pay down overall debt.

Remember, Voxx is Undergoing a ‘Strategic Process’

Voxx once again reminded investors that the company is deeply in the process of a strategic review of its business. This “strategic process” is partly responsible for the company selling off its domestic accessory business, non-core audio brands, and its OEM factory building, to generate cash, lower overhead, and pay down debt.

But this review goes even deeper than these initiatives. Lavelle reminded investors the Board “will consider a range of options including, among other things, a potential sale of the Company, a sale of segments, operational improvements, or other strategic transactions.”

Lavelle Heavily Hints A Buyout Deal for Voxx May Be In the Works

Then, in response to an analyst question during the earnings call, Lavelle heavily hinted the company already has received an offer for the entire company – and he expects to see more offers for the entire company. He mentioned that the company has received an offer from Gentex – an automotive parts supplier who has made an investment in Voxx, and whose CEO sits on the Voxx Board of Directors. Lavelle mentioned the Gentex name multiple times during the earnings conference call.

We are in a process, and that process is to determine the value of the company. And there will be, in my estimation, offers for the entire company – which you have seen with the Gentex offer. And we believe that there will be additional offers for the entire company, and there will be offers for, you know, the sum of the parts

Pat Lavelle

More Change Is Almost Certainly Coming

Summing up the earnings report for Q2 / FY2025, Voxx is in the middle of transforming the company in a dramatic fashion. It will either move forward as an independent (for now) company that is smaller, more profitable, and with lower debt and capital requirements than in the past; or it will be sold in part or in whole.

There was a lot of buzz back when Gentex bought large tranches of Voxx stock, both directly and by purchasing 50% of the shares held by Beat Kahli. Some speculated that this was the first part of a buyout/takeover of Voxx. (You can see details on this by scrolling to the bottom of this post…)

Based on Lavelle’s language during the earnings call, the possibility of a Gentex buyout of Voxx is looking like more than just a rumor.

Learn more about Voxx by visiting voxxintl.com.

Leave a Reply