On Tuesday, Voxx International Corporation (Nasdaq: VOXX) held its annual shareholders meeting, closing out a tough Fiscal 2024 with declining sales (down 12.2%) and deepening net losses (up over 53%). Sounding a little defensive, Ari M. Shalam, the company’s Co-Vice Chairman of the Board and son of company founder John J. Shalam, promised investors more restructuring and said the company will shed assets, including some of its previous brand acquisitions, to generate cash to lower debt and prepare the company for healthier growth ahead.

See more on the remarkable Voxx Annual Shareholders Meeting

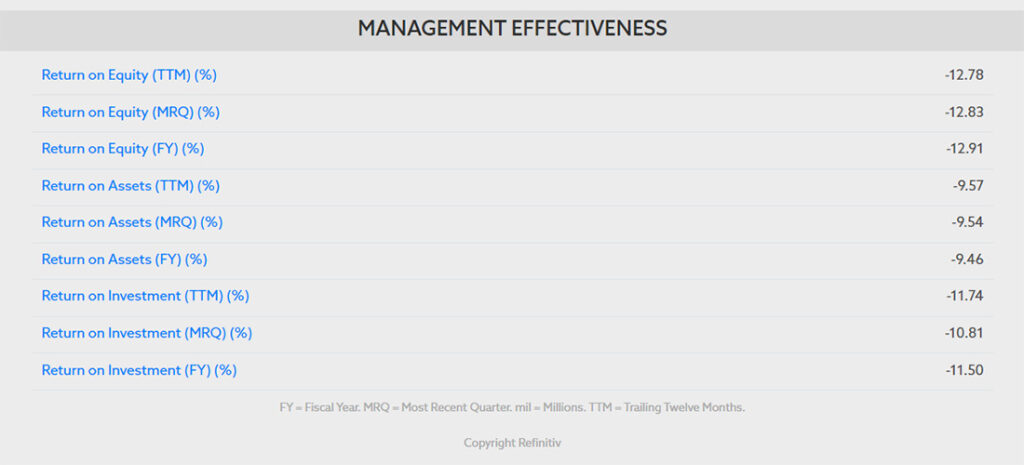

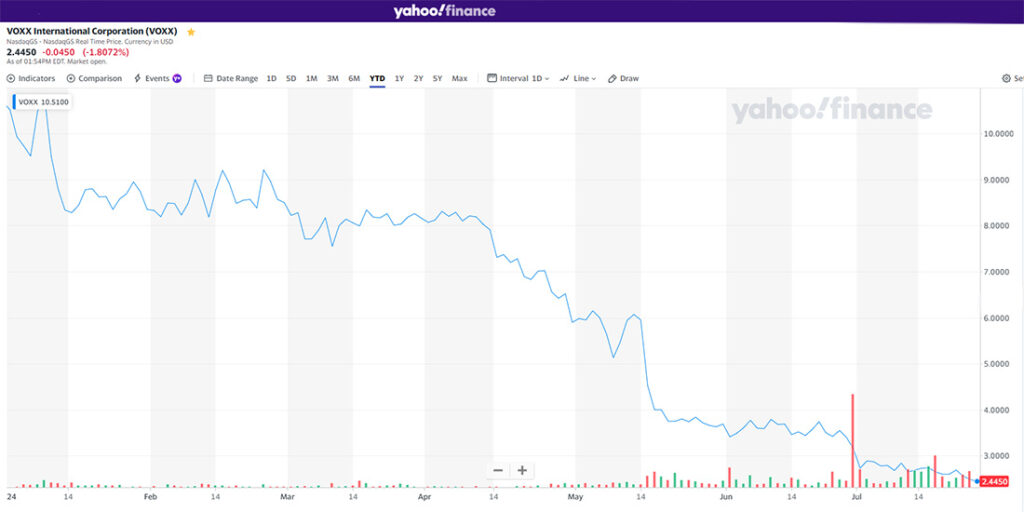

This year’s annual shareholders meeting was held as a virtual (online) meeting and only lasted, in total, less than thirty minutes long from opening welcome to closing remarks. Fiscal 2024 was a tough year for the company, as was Fiscal 2023 before it. Despite the best efforts of company management, including a couple of rounds of staff layoffs, investors watched the value of their stock continue to decline as the company’s numbers continued to deteriorate – other than a marginal profit improvement from aggressive cost cutting.

The meeting opened with a reading of the proposals before shareholders to vote on. These proposals included: 1) Electing seven Board members; 2) Approving the company’s 2024 Equity Incentive Plan; and 3) Ratifying the selection of Grant Thornton LLP as the company’s independent registered public accounting firm. The company noted that an appropriate number of shares were present at the meeting to represent a quorum “for the purpose of conducting business.”

Voting Took One Minute…Literally

The meeting was opened up for voting and one minute later voting was complete. All proposals were approved. How could this be done so quickly? Mainly for two reasons: First, the board and management holds a massive chunk of all of the stock of the corporation. There are two classes of stock, Class A and Class B. Voxx directors hold 44.61% of all Class A stock and 96.6% of all Class B stock (which is held by founder John J. Shalam and his son Ari Shalam).

Second, the company can collect votes or proxies in advance of the meeting, so most votes are already pre-counted. In any event, shareholders voted in favor of the management in all of the above initiatives. This is not a big surprise, given the collective voting power of the directors.

Then the meeting was turned over to Ari Shalam to provide an overview of Fiscal 2024 results and reveal plans for Fiscal 2025, which the company is in now. For those who have participated in multiple earnings calls over the last few quarters, it was refreshing to hear this coming from someone new at the company rather than the typical CEO Pat Lavelle presentation.

Ari Shalam, Co-Vice Chairman of the Voxx Board; ‘Obstacles in Fiscal ’23 Persist Today’

However, having said that, the script might as well have been written by Lavelle, as Shalam’s presentation mimicked the language and major points of Lavelle’s last few earnings calls. Reading from a script, Shalam sped through his presentation making it hard for those of us taking notes to keep up with him.

When I spoke to you at last year’s annual meeting, I talked a lot about the global environment, operating environment and the myriad of challenges we faced in Fiscal Year 23 – as well as the steps we were taking in Fiscal Year 24 to improve. I spoke of global economic headwinds, OEM production delays, inflation, rising interest rates and the general retail retrenchment. This should sound familiar as virtually all of the obstacles in Fiscal 23 persist today.

Ari M. Shalam, Co-Vice Chairman of the Voxx Board of Directors

Not All Bad in Fiscal 2024; Yet ‘New Challenges’ Emerged

Not everything was bad, Shalam told investors. The supply chain began to normalize, retail inventories began to come down in certain categories, and costs began to decline “helping us better manage inventory and planning,” Shalam said. But…

However, we had some new challenges to deal with, namely the UAW strike which caused further OEM production disruptions, trending de-globalization, new and continued armed conflicts and their global impact on producers and consumers. And a shift in discretionary consumer spending as the impact of the Feds rate increases took hold.

Ari Shalam

Shalam: The Company Needs to Be ‘Nimbler’

He admitted that the company needs to be “nimbler” such that it can better conform to fluctuating market conditions. It needs to get better at driving profits, generating cash, and enhancing value. But have no fear, because “…that’s precisely what we’re doing.”

He reminded investors that the company had previously warned about a “soft top line” in Fiscal 2024. He also acknowledged that it had expressed optimism for the second half of the fiscal year. However, “economic hurdles” and “OEM plant closures” were just too much to overcome.

Customers ‘Inability to Effectively Forecast Demand’ is a Big Challenge

Apparently, the culprit is Voxx’s customers. “We manage our business based on customer projections and, as Pat indicated on the most recent earnings calls, their inability to effectively forecast demand has been one of the biggest challenges to navigate.”

There were no mea culpas, no apologies, no honest admissions of poor judgment – even though some could argue that the company made risky and ill-advised investments in businesses for which they over-forecasted positive results. This is a key part of management’s job – forecasting. While you may seek customer’s input, at the end of the day it is your job to know their business as well as – or ideally, even better than – the customer does. Lavelle and his managers are responsible for their forecasts, including keeping closely in tune with economic developments.

Why You Get the Big Bucks

Oh, I know, this isn’t easy. But, as they say, that’s why you get paid the big bucks.

In any event, Shalam recited many of the moves the company made to cut costs, lower overhead and improve margins. Still, in 2024 gross margins were down 80 basis points, “primarily due to all the stops and starts in our Automotive group,” he said.

For the Fiscal 2024 year, operating expenses were brought down by 2% – 7% if you exclude impairment charges and restructuring expenses…which, of course, you can’t exclude. Still…”With the sales declining higher than anticipated and the corresponding impact on margin income, we reported higher year-over-year losses, a trend we are working hard to ensure does not repeat,” the co-Vice Chairman said.

A Little Brighter in Fiscal 2025…a Little

For Fiscal 2025, Shalam was more sanguine, “Through the restructuring plan we initiated and the positive impact of prior steps taken to improve our cost structure, we saw a big increase in gross margins up 310 basis points. And our operating expenses declined by 16%, resulting in losses – but losses below prior-year levels.”

The company says there will be “additional restructuring efforts instituted” in Fiscal 2025 “focused on driving business across higher margin more stable product categories, further reducing overhead and exiting non-core products. All of this is being done with an eye towards optimizing capital allocation and right-sizing our organizational and cost structures to be profitable at lower sales levels.”

Freeing Up Cash and ‘Management Bandwidth’

The goal is to free up cash and “management bandwidth” to reinvest in the business. As we learned after last quarter, the company is also hiring an outside consultant called Accordion to analyze its business and “review all aspects of how we operate, and ways in which we can best optimize performance.” Accordion, Shalam noted, has a “significant private equity clientele.”

The company has moved its money-losing biometric unit off the balance sheet and into a joint venture. This year, Voxx will be implementing a new ERP system which is costly and time-consuming to implement but will allow them to be more efficient in the future.

With Debt Too High, Company Will Liquidate Assets…Including Brands

Then Shalam turned to what I would call the bigger news. The company has determined its debt level of $60 million is too high. It got that way when it was hit with an adverse arbitration ruling in the Sea Guard lawsuit, along with some extraneous mortgage costs, that combined to add $42 million to its debt. Since it couldn’t accrue for this judgment from excess profits (it hasn’t been profitable for a couple of years now), the company was forced to draw down on its credit line.

To address this situation, the company has decided to begin liquidating some of its assets, including real estate (the Orlando facility, now that it has shifted Automotive production to Mexico) and previously acquired “non-core” brands and businesses. Which brands are they selling? They won’t say just yet. However, Shalam noted that they are now in “advanced discussions” to sell a non-core brand to a competitor in the same space in a transaction expected to be completed in the third quarter.

Selling a ‘Lesser Known Brand’ for ‘Several Million Dollars’

Then Shalam added, “…we are in advanced discussions to sell one of our lesser known brands that should generate several million dollars in proceeds that will further help to shore up our balance sheet. And lastly, we have identified other potential non-core brands or business lines that we believe could be taken through a similar process and are in the early stages of advancing those efforts.”

Shrinking to Greatness?

However these moves, Shalam admits, will result in lower sales, but “they should also improve operating performance.”

[W]hile acquisitions comprise many of our businesses today, and there may be acquisitions that make up our business in the future, for now our focus is clear – debt reduction, business enhancement and capital optimization. [We’re] not purely banking on the markets to provide a tailwind that can boost sales and performance. It is critical that we, as your board, take the initiative now to right-size the company and best position Voxx for efficient growth and improved performance down the road. In many respects, this follows to what is often a counterintuitive business strategy that I like to call shrinking to greatness.

Ari Shalam

Once again, Voxx executives are saying all the right things…but they’ve been doing that for two years now. In trading today, the company’s stock hit a new 52-week low of $2.43/share and closed at $2.44/share. On January 9th, VOXX stood at $10.85/share.

Investors have seen their investment drop by 77½% year-to-date. Is this what “shrinking to greatness” means?

Learn more about Voxx International by visiting voxxintl.com.

Leave a Reply