Value of VOXX Stock Drops 23.9%…Hits New 52-Week Lows

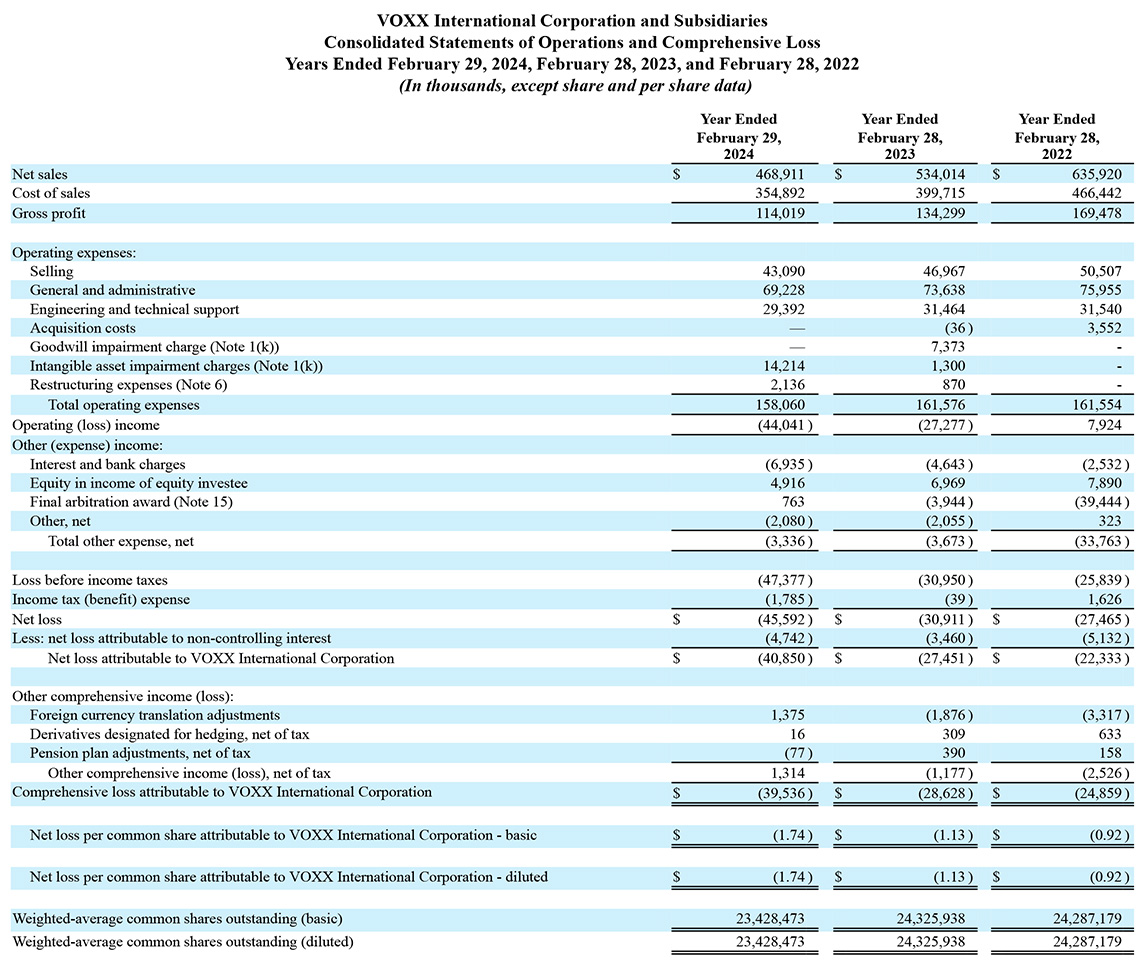

After markets closed on Tuesday, VOXX International Corporation (NASDAQ: VOXX) released its Fiscal 2024 fourth quarter and full-year financial results for the period ending February 29, 2024…and it wasn’t a pretty picture. Net sales in Fiscal 2024 were down a double-digit percentage at 12.2% and the company’s Net Loss ballooned to an eye-popping $45.6 million.

What can investors expect in Fiscal 2025 from Voxx? At best, flat sales but the company is hoping to engage in a protracted restructuring process to try and reattain profitability.

See more on the VOXX report of financial performance in fiscal 2024

VOXX CEO Pat Lavelle got right to the heart of the matter on an earnings conference call with financial analysts. “Simply put, Fiscal 2024 was even tougher than Fiscal 2023 and the challenges we faced are reflected in our results,” Lavelle said in a firm, straightforward manner. He added, “Like nearly every company serving our markets, we continue to feel the impact of a very challenging global economy.”

An Edge to Official Reports of Its Fiscal 2024 Results

For those unfamiliar with VOXX Int’l, it is a diversified company that, up until 2021 was largely a manufacturer and distributor of OEM and aftermarket automotive electronics, including audio/video and non-a/v items. In 2011, the company, seeking to diversify its business interests, acquired Klipsch Group taking it into the consumer loudspeaker business. In 2021, seeking further diversification, the company partnered with Sharp Corp. (part of Apple supplier Foxconn) to acquire Onkyo.

It was then I began to follow VOXX. The company has struggled with the roiling post-pandemic business environment and since the Onkyo acquisition, has struggled to right the ship. Now, in reviewing its Fiscal 2024 results, we see further evidence of their struggle – delivered with a bit of an added edge by company executives.

Dramatic Leaps and Pirouettes

Like a frantic ballerina who hopes dramatic leaps and artistic pirouettes will distract the audience from noticing the sometimes terrible story that’s being portrayed, Lavelle bounces back and forth between a forceful this-is-how-it-is kind of affect…to one of a more optimistic we-are-gaining-market-share and we-are-optimistic-about-the-future.

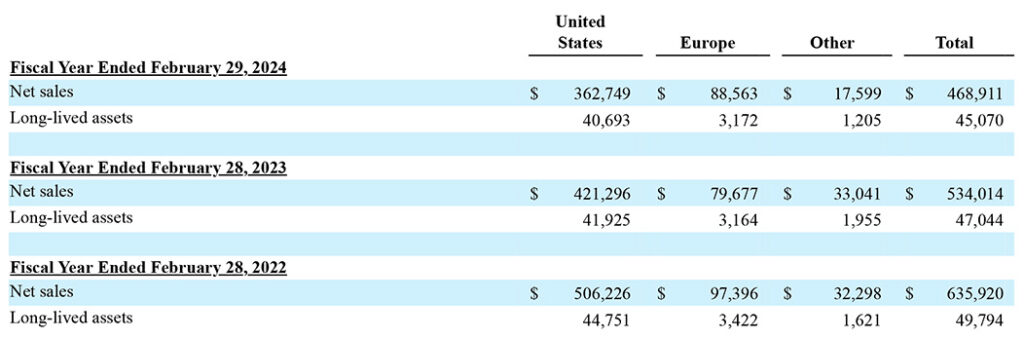

I’m going to skip the quarterly results and focus instead on the full-year performance as each period was influenced by essentially the same issues. Net Sales in Fiscal 2024 came in at a disappointing $468.9 million, down $65.1 million or 12.2% as compared to net sales of $534.0 million in fiscal 2023. By itself, this is a head-shaking result – but remember that last year, net sales at $534 million were down $101.9 million or 16% from net sales of $635.9 million in fiscal 2022.

Despite a myriad of actions taken by the company in the wake of a disastrous Fiscal 2023, we see at the end of Fiscal 2024 that its business deterioration continues. So now what?

A Concerning Sales Slide Continues

It appears that, despite the many adjustments the company made during fiscal 2024, such as running promotions to flush out underperforming inventory, introducing several new models to gain placement around the world, and more, its concerning sales slide continues. (The fourth quarter alone, saw sales decline 20.8%).

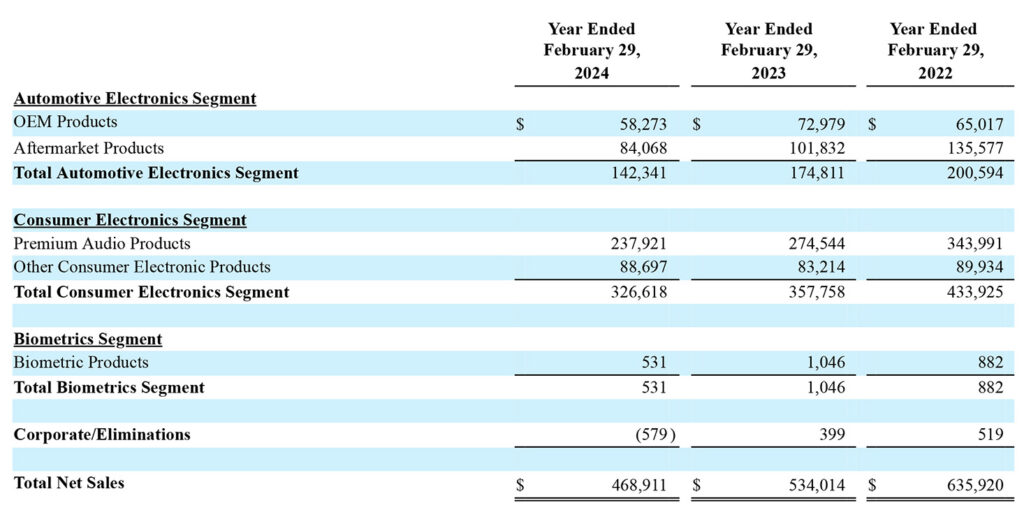

The company has three major lines of business: Automotive, Consumer Electronics, and Biometrics. All three divisions had net sales declines. Two of the three major business units have sub-segments, as well…

- Automotive: OEM (e.g. remote start, rear-seat entertainment, security) and Aftermarket

- Consumer Electronics: Premium Audio (major audio products, such as Onkyo, Integra, Pioneer, Elite, Klipsch, Jamo, Energy, Magnat, and more) and Other CE

- Biometrics has no subcategories

Business Segment Performance

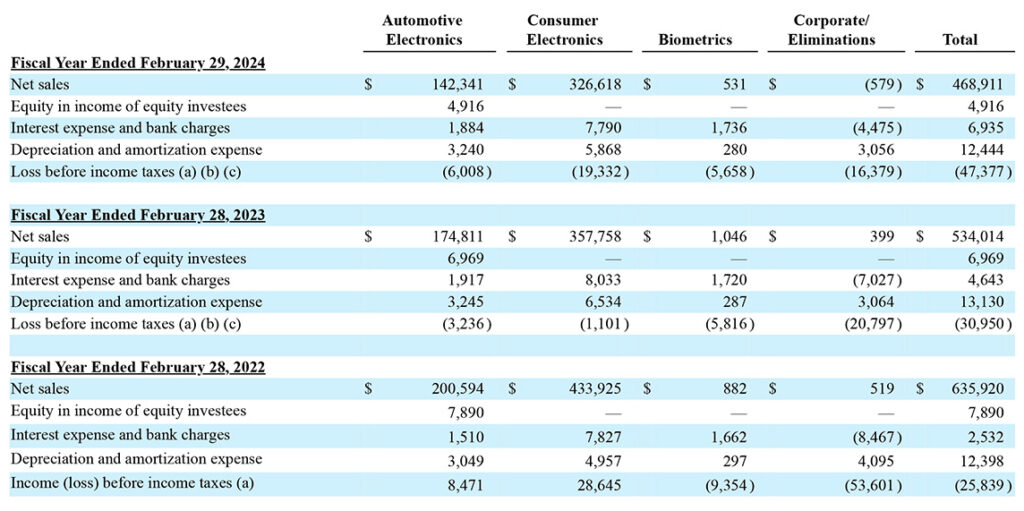

The Automotive Electronics division, the business the company has been in the longest, saw its fiscal 2024 net sales come in at $142.3 million, down $32.5 million or 18.6% as compared to net sales of $174.8 million in fiscal 2023. OEM product sales were $58.3 million, down $14.7 million or 20.1% compared to net sales of $73.0 million the previous year. Aftermarket sales were $84.1 million, down $17.8 million or 17.4% compared to sales of $101.8 million in 2023.

Consumer Electronics had net sales come in at $326.6 million which is $31.1 million or 8.7% below the net sales of $357.8 million in fiscal 2023. Premium Audio product sales came in at $237.9 million which is $36.6 million or 13.33% below sales of $274.5 million in the last fiscal year. The only product category for the company that actually saw a sales increase was the rather generically named Other CE which had sales of $88.7 million, which is $5.5 million or 6.6% higher than the sales of $83.2 million in the previous fiscal year.

‘Softness in the Global Economy’; A/V Receiver Sales Collapse by Tens of Millions of Dollars

The company said that the double-digit percentage sales decline in Premium Audio was largely attributed to “softness in the global economy and challenging retail, supply chain and consumer environments which led to lower sales of premium audio and receiving products. I’m not sure what “receiving” products are, but this is probably a reference to A/V receivers. In the company’s SEC filing, VOXX revealed “..the decline in domestic sales of its Onkyo and Pioneer receiver products of approximately $16,200 [$16.2 million]…” this year. They also added that in “both Europe and Asia, sales of the Company’s premium audio products and receiver products decreased approximately $14,500 [$14.5 million]” in 2024.

Specifically addressing the receiver sales declines, the company attributes the shortfall to the fact that they experienced a large buy-in of receivers in Fiscal 2023, but now this year “the Company has been experiencing a more normalized market for these products, as well as some additional slowing of consumer spending in response to current economic concerns.”

Other CE benefitted from higher European accessory sales of the company’s balcony solar power products that debuted in the back half of the year.

The company also noted that sales of its newly introduced RCA hearing aid products also saw sales increases in fiscal 2024, but didn’t provide any specific sales numbers for the category.

The Biometrics division had net sales this year of $0.5 million, down $0.5 million or 50% as compared to sales of $1.0 million in fiscal 2023. This is a tiny business for a company the size of VOXX that is related to iris scanners for access-control security systems. The company has for years now predicted that this product category was going to take off and be huge for certain mission-critical businesses, such as nuclear facilities, military installations, financial institutions, and more. But despite years of positive talk, it just hasn’t seemed to really get off the ground. A business unit generating only $500,000 in total annual sales is just not meaningful…and certainly not profitable for the company, as you’ll see in a table below.

Taking Steps to ‘Realign’; Losses are Not a Pretty Picture

After two strong years of growth and profits on an Adjusted EBITDA basis, we have experienced losses and as such, are taking steps to realign, both to improve margins and lower expenses. Fiscal 2024 was a tough year and we expect market conditions to remain challenged given inflation and global concerns. With that said, we have a number of new products both in and coming to market and new automotive programs starting in the second half of the year, which will help combat market softness. We have implemented new plans to improve margins and lower expenses to ensure VOXX’s profitability. Concurrently, we are focused on improving capital returns, cash flow and our balance sheet.

Pat Lavelle, VOXX CEO

The profit picture is not a particularly pretty one either. VOXX generated a loss from operations (Operating loss) of $44.0 million which is $16.7 million or 61.1% higher than the operating loss of $27.3 million in fiscal 2023. Likewise, the company had a Net loss of $40.9 million this year, which is $13.4 million or 48.7% worse than the net loss of $27.5 million last year.

The company went through several of its expense items and noted that it had made good progress in reducing expenses in several areas. While the numbers they presented certainly made that case, it clearly couldn’t cut expenses enough to achieve profitability. Most of that overhead improvement was by cutting headcount, as the company has had two full rounds of job cuts which reduced salary, benefit, and commission expenses for the company.

The Cost Cutting Will Keep on Coming

From what Lavelle told analysts, more of this cost-cutting effort is coming. Both Lavelle and new CFO Loriann Shelton, who was/is? the company’s Chief Operating Officer, referred to VOXX’s fiscal 2025 “realignment plan.” Says Lavelle…

We plan to cut at minimum an additional 5 to 10% of our total overhead without affecting our ability to effectively serve our customers. Not only will we be cutting costs, but we’re also reviewing all products and programs, which I will cover in more detail during my market segments. Our programs are about right sizing the company based on the projections that we see for this year.

Lavelle

A $14.2 Million ‘Intangible Asset Impairment Charge’

After two consecutive years of losses on an “adjusted EBITDA basis” – I would say three years of net losses on a GAAP (generally accepted accounting practices) basis – the company has been forced to further recognize the reality of its situation and take action. Proof of that exists in the form of an “intangible asset impairment charge” of $14.2 million and restructuring charges of $2.1 million taken in fiscal 2024. The impairment charge is an admission that some of its brands are not worth as much as they originally thought or are carrying on the books.

The company says it took this charge against earnings for four brands within the Klipsch and Onkyo reporting units, without specifically naming which brands had their value written down. I’d be willing to bet that Onkyo was one of those as I’m hearing that they experienced intense competition on AVRs.

Company Auditors Flag a ‘Critical Audit Matter’

By the way, VOXX didn’t implement the charge against earnings out of the goodness of its heart. I learned from deep in the company’s Form 10-K filing with the Securities and Exchange Commission that the company’s auditors flagged “Goodwill Impairment Assessment – Klipsch and Onkyo Reporting Units” as a “critical audit matter” in their review of the company’s books. Likely, company management couldn’t ignore that finding from the auditors and implemented the $14.2 million charge to earnings. Nonetheless, it was done.

As he has done in quarter’s past, Lavelle spit out a laundry list of issues impacting the company’s performance, such as: “The economy, credit card debt at an all-time high, discretionary spending is down, inflation is a major concern, we have uncertain elections upcoming, and mounting geopolitical tensions. I could go on and on… The Fed not easing rates could have the biggest impact as it directly affects customers buying…consumers purchasing…and the cost of doing business.”

Don’t Worry, We’re Still Taking Market Share

But, Lavelle claims to analysts, the company is still taking market share. They are, he maintains, certain that things will improve and VOXX’s position will be even better as they take this time to build the new businesses they are in.

Yet it is hard for me to shake the impression that this quarter – and fiscal year – report sounds almost exactly like the previous ones. The company has taken many steps, including headcount reduction, cost-cutting, and more – and yet all signs point to their problems continuing. Even Lavelle admitted that in preparation for this year’s announcement he looked at his comments for the fiscal 2023 earnings call, and they were pretty much the same as his comments for this year’s call. That means that despite a year of effort on the company’s part…not much has changed…at least in terms of the results.

Analyst Call Q&A…Without the Q

A final interesting tidbit in this story was a rather unusual question and answer session with analysts. After CFO Shelton finished her presentation where she basically echoed Lavelle’s cost-cutting and efficiency improvement promises, the call was turned back over to the operator to set up the question-and-answer session with analysts. These Q&A sessions often give me a picture of how Wall Street views a report.

The only problem is that this time, nobody had any questions…so the call was terminated.

See more on Voxx by visiting voxxintl.com.

Leave a Reply