Will Voxx International Itself Be Sold? It Says It’s Exploring *All* Options

Premium Audio Company (PAC), a division of Voxx International Corporation (Nasdaq: VOXX), announced today that Voxx has sold off both the Jamo and Energy brands as part of its plan to divest multiple brands in an effort to stave off its financial decline and revitalize its profits. The brands were sold to a Chinese manufacturing company and a Chinese distributor. Oddly, this announcement was retroactive, as the transaction was said to have taken place on August 15, 2024. No reason was given for why this announcement of the transaction was withheld until now.

See more on Voxx selling off underperforming brands

In the wake of this two-week-old transaction that we have just learned about, PAC says that “the companies are collaborating to ensure a seamless transition for all customers and partners served.” And to whom are these brands being sold?

The company says that Rayleigh Labs has partnered with Cinemaster to acquire the brands. Rayleigh Labs is a Shenzhen, China-based R&D and manufacturing company. It is headed up by founder and CEO Thomas Li. Cinemaster – founded by Xiaodong Yang – is a distributor in China that PAC describes as “the largest audio distribution company in China.” Apparently, these two Chinese entities are partnering to take over the Jamo and Energy brands.

Chinese Buyers are Suppliers to PAC/Voxx

It turns out that both of these companies are long-time suppliers to Voxx/Premium Audio Company. Rayleigh Labs, PAC says, “is…one of the most significant R&D and manufacturing partners of the PAC group.” And Cinemaster “has been the distribution partner for all PAC brands for more than two decades.”

So they should both know what they are getting themselves into…

We are honored to be stewards of the Jamo brand and are dedicated to upholding its core values while driving its growth. Our goal is to enhance Jamo’s reputation for excellence and innovation, ensuring it continues to resonate with audio enthusiasts around the world.

Xiaodong Yang, Cinemaster Founder and CEO

Jamo Once the Largest Speaker Manufacturer in Europe

Jamo was founded in 1968 in Denmark and at one time, with more than 400 employees, it was Europe’s largest speaker manufacturer, according to Wikipedia. The high watermark of the company is said to have been in 1998 when it shipped more than 11.5 million units worldwide. In 2002, a turnaround specialist was brought in due to deteriorating sales. He was unsuccessful in returning the company to growth and the brand changed hands a couple of times – finally shifting production to China. Klipsch, a division of VOXX, acquired Jamo in 2005.

We are thrilled to support Rayleigh Lab[s] and Cinemaster in this exciting new chapter for Jamo. With their expertise and dedication, we are confident that Jamo will continue to set new benchmarks in the audio industry. This acquisition is a significant step in positioning Premium Audio Company for long-term success.

Vince Bonacorsi, Premium Audio Company Chief Operating Officer

A Clue Emerges as to Why Deal was Announced Retroactively

As I mentioned above, today’s announcement was oddly made retroactively…with no explanation as to why. However, perhaps a clue emerged on Tuesday when Voxx International distributed a press release titled, “VOXX International Corporation Announces Strategic Alternatives Process to Maximize Valuation.” This release noted that the company was “conducting an exploration of strategic alternatives in connection with its ongoing effort to maximize shareholder value.”

The alternatives being considered are apparently wide-ranging, as the announcement noted that “…the board will consider a wide range of options for VOXX, including, among other things, a potential sale of the Company, a sale of segments, operational improvements, or other strategic transactions.” [emphasis added]

Speculation that Voxx Will Be Acquired

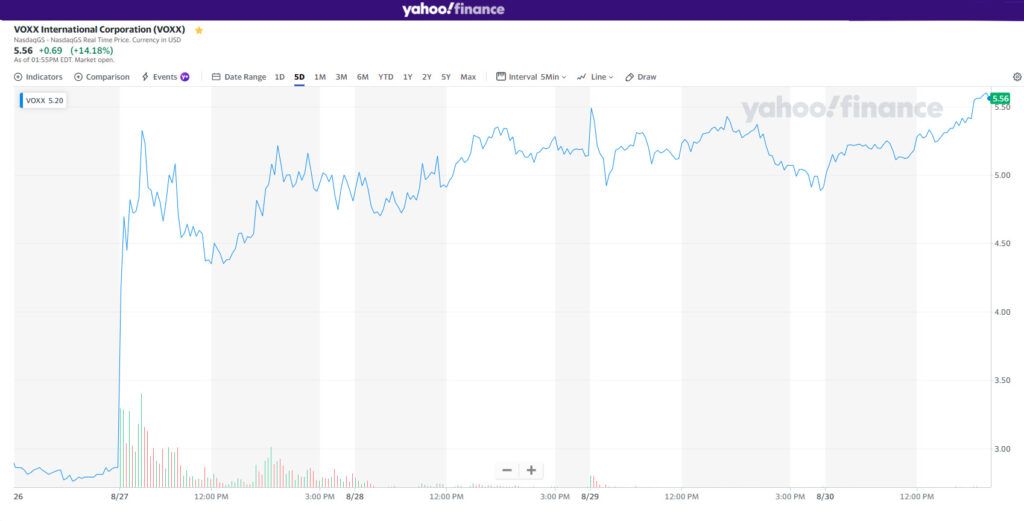

This has fueled speculation that has almost doubled the value of VOXX stock since Tuesday. There are many speculators who believe the company put out this statement because a deal was in the works and there could be a quick increase in stock price paid to acquire the company.

In late afternoon trading, shares of VOXX stock increased 13.5% to $5.53.

Perhaps this dynamic situation regarding a potential sale of Voxx is what drove the company to retroactively announce the divestiture of Jamo and Energy.

Stay tuned…more details are surely to emerge.

See more on Voxx by visiting voxxintl.com.

Leave a Reply