All Categories Declined Except Premium Audio, Up 1.6%

Voxx International Corporation (Nasdaq: VOXX) reported its financial performance after markets closed on Wednesday for its Fiscal 2025 first quarter, the 90-day period that ended on May 31, 2024. The result was a mixed bag, including a shocking 18.1% decline in reported net sales, but also a bit of a counterbalance to that with news of a reduced loss due to the company’s extra effort to control and lower its cost structure.

Learn all about the VOXX report released this week

Voxx is a diversified manufacturer and distributor of technology products, predominantly in the automotive electronics and consumer electronics spaces. In the case of consumer electronics, Voxx carries popular brands such as Klipsch, Pioneer, Onkyo, AR, Integra, RCA, Terk, Jensen, Magnat, Energy, Jamo, Heco, and more. Some of these brands are marketed via a subsidiary known as Premium Audio Company.

The company has released its financial performance data for the first quarter of Fiscal 2025. As I mentioned above, it was truly a tale of mixed results. The dramatic drop in net revenues – down 18.1% – is concerning and is relatively broad-based amongst the company’s categories. The company has aggressively dove into a major restructuring of its business that included a headcount reduction and a cutback in almost all major expense spending.

Sounding the Alarm for Several Quarters as Consumer Markets Remain Stressed

The company has been sounding the alarm about challenging economic conditions, a subject it discussed extensively in its recent Fiscal 2024 wrap-up. Lavelle took time to readdress some of those issues and to further discuss steps the company is taking to address its flagging performance.

During the first quarter, we took aggressive steps to improve gross margins and lower both our operating expenses and working capital needs. While our sales were down for the comparable periods, gross margins improved in our Automotive and Consumer segments, and we reduced year-over-year expenses by over 16%. The retail environment remains challenging, interest rates are high, and inflation is still a major concern. With market pressures expected to continue, we have instituted various restructuring programs to right size our business. We are equally focused on reducing our debt and freeing up capital to re-invest in VOXX. With the changes made and upcoming, we expect to return to profitability this year.

Pat Lavelle, Voxx Intl Chief Executive Officer

Voxx May Put Brands Up for Sale

Lavelle went further in his description of moves the company will continue to make to restructure its business – promising profitability in the second half of the year, no matter how challenging the sales environment remains. Acutely aware how bad Voxx’s performance looks to the investment community, he told analysts that basically everything is on the table.

…we are in a number of discussions regarding divesting some of our business assets and potentially some of our brands.

Pat Lavelle

Talk of divesting business assets…and especially brands…was a deliberate effort by Lavelle to let the investment community know that the company will do whatever it takes to right the listing ship.

So let’s dig into the performance at Voxx…

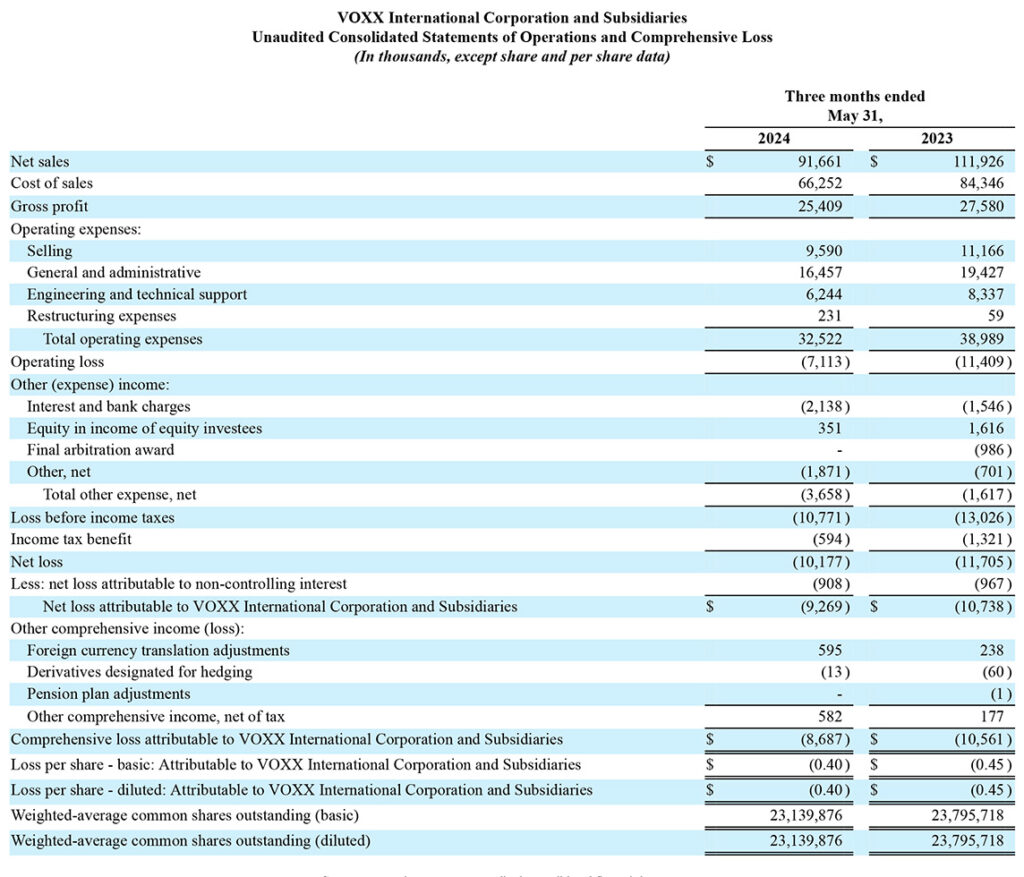

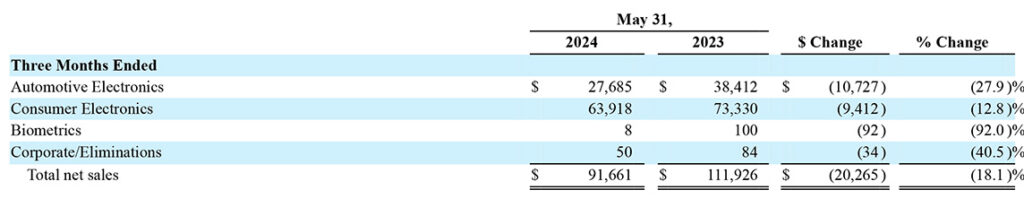

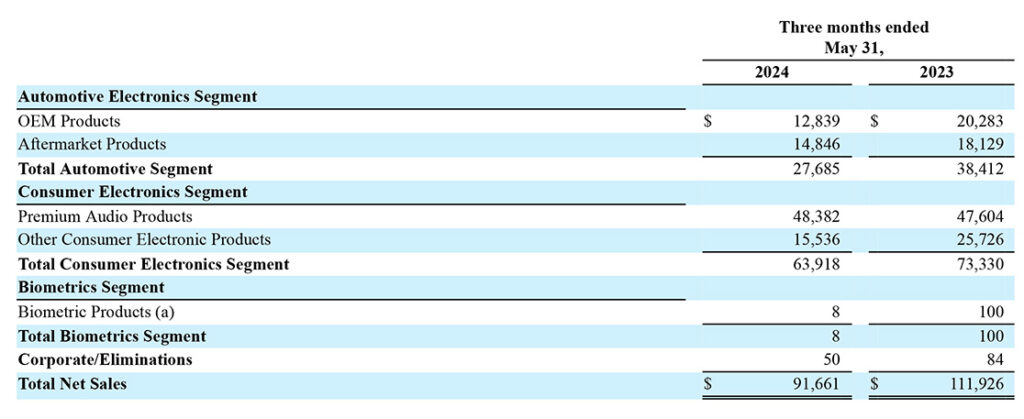

Total Net Sales in the quarter were $91.7 million which was a decline of $20.3 million or 18.1% as compared to Net Sales of $111.9 million in the same quarter last year. Net sales for Automotive Electronics came in at $27.7 million, down $10.7 million or 27.9% compared to the same period last year. Consumer Electronics net sales came in at $63.9 million which was a decrease of $9.4 million or 12.8% compared to Q1 in Fiscal 2024.

In a disaggregation of sales, we see that the sales declines were across the board in virtually every product category, except for one. Only one category showed growth and it is Premium Audio Products, a category that has struggled for several quarters now. But in Q1/FY2025 they were a bright spot – net sales came in at $48.4 million which was an increase of $778,000 or 1.6% over net sales of $47.6 million in the quarter last year.

Premium Audio Products are a Bright Spot. A Slight Bright Spot, That Is

In addition to this, CFO & COO Loriann Shelton told analysts that Premium Audio Products sales increased 11% in the domestic market. However, the PAP business didn’t fare so well in other markets around the world. The Premium Audio Products increase in the U.S. was largely due to the introduction of new models.

But keep in mind, all other product segments saw their business decline in the first quarter this year as compared with Fiscal 2024.

Voxx is Still Not Profitable

Voxx’s announcement spent a considerable amount of time discussing how it has lowered expenses in almost all key categories. That is laudable and the company did succeed in lowering its overhead, improving its working capital, and boosting margins. That didn’t come without some pain, however, and many employees took the brunt of that pain in companywide layoffs.

The result is that while the company remained unprofitable, there was a clear and measurable improvement as losses were reduced. For example, the company reported an Operating Loss of $7.1 million this quarter, which was about a $4.3 million improvement over the Operating Loss of $11.4 million in the same quarter the previous year.

A $10.2 Million Net Loss; Company Vows Profitability Later This Year

The same can be said about the company’s Net Loss of $10.2 million which was a $1.5 million improvement over the Net Loss of $11.7 million in Q1 of Fiscal 2024.

Still, Shelton told financial analysts that the company expected to lose money again in the second quarter of Fiscal 2025. However, they confidently suggested that they would turn profitable in the back half of the fiscal year.

A Select List of Margin Improvements

- Overall Gross Margin was 27.7% this year versus 25.5% a year ago – a 310 basis points improvement

- Automotive Electronics segment gross margin was 23.2% this year versus 21.0% last year – a 220 basis points improvement

- Consumer Electronics segment gross margin was 29.6% this year versus 25.5% last year – a 410 basis points improvement

Here is a quick list of the expense reductions the company reported…

- Total Operating Expenses this year were $32.5 million, a decline of $6.5 million or 16.6% compared with total operating expenses of $39.0 million in the quarter last year. The company says this was driven by restructuring programs and other initiatives designed to lower costs and working capital needs.

- Selling Expenses came in at $9.6 million which was $1.6 million or 14.1% lower than selling expenses of $11.2 million in Q1 last year

- General and Administrative (G&A) Expenses were $16.5 million which is $3.0 million or 15.3% lower than G&A expenses of $19.4 million the same quarter in Fiscal 2024. The company says this reduction was largely due to lower headcount-related expenses and a decline in legal, professional and third-party fees.

- Engineering and Technical Support Expenses came in at $6.2 million this year which was a $2.1 million or 25.1% improvement over the expenses in the category of $8.3 million in the quarter last year. The company again attributed the improvement to a lower labor expense thanks to a reduced headcount and lower investment in research and development.

Lavelle to Investors: ‘Be Assured, We Have the Same Concerns as Our Investors’

On a conference call with financial analysts, Lavelle sought to strike a tone of ‘We got this’ competence, identifying the heavy market, industry, and company challenges – and promising more aggressive restructuring and efforts to transform the company for the times. The problem is, he’s taken this approach before, and yet several quarters later…here we remain.

The CEO has also recently reassumed the role of company president, as previous president Beat Kahli transitions to a Board Director role as well as Board Co-Vice Chairman. Lavelle started with a familiar refrain of his favorite business bugaboos – high interest rates, high inflation (“a major concern”), and a “challenging retail environment.” He reminded analysts that on the last earnings call, he had warned them “…that sales would be under pressure based on what we were seeing at retail and given the state of the automotive market.”

CEO Vows to Emerge from This Period as ‘A Stronger Company’

In addition to market issues holding back top-line growth, we, too, are uncomfortable with our current debt level and our depressed share price, which is sitting near 52-week lows. Be assured, we have the same concerns as our investors. Voxx has been around for over 60 years. We have seen just about everything, and we have always preservered. This time will be no different.

Lavelle

The Voxx CEO vowed that “we will emerge from this turbulent period as a stronger company, with better investor returns.” He recalled the company’s last major restructuring in Fiscal 2019 and 2020. These years were followed with two years of “profitability and cash flow which propelled our stock to trade over $20 per share. NOTE TO READER, the years he’s referring to are the two years just prior to when the company acquired Onkyo. I would say, this is when the company’s challenges really began to take off.

Further Restructuring Needed, All Brands and Businesses to Be Assessed

Lavelle admitted that the past two years have “seen a myriad of global challenges, causing us to miss revenue projections as our customers struggle with ever-changing demand.” To address these continuing challenges, Lavelle said, “…we are adjusting and taking action to rightsize our business based on what we believe sales volumes will be in the near term while maintaining operating leverage to capture increases in sales and market share without significantly rescaling overhead. Our focus is clear.”

With over 35 brands and operating groups, the Voxx CEO says all products, channels, markets, and businesses will undergo a tough assessment to determine if they meet the company’s new “stability, profitability, and growth potential” goals. The winners will be those that generate positive margins and consistent returns. He heavily suggested the losers would be divested.

Company Has Retained A Private Equity Consultant; Is Voxx Up for Sale?

The company has hired Accordion, a consulting company, to help them drive this process. Incidentally, Accordion markets itself as “The Leader in Private Equity Consulting.” Is Voxx putting itself on the market? That’s not how Lavelle puts it. He says Accordion will help them with an outside perspective on “other optimization programs we could implement this year.”

In any event, Lavelle suggests changes, perhaps big changes, are yet to come. Of the company’s many brands and business categories in which they participate, he notes that some “…of the categories are in growth mode, while others are less profitable, with slow to no growth. As part of our restructuring, we are again looking at every product and SKU, every customer program, and determining our true cost to serve…”

Discussions on Divesting Business Assets and ‘Potentially Some of Our Brands’

Driving the point further, Lavelle added, “And we are in a number of discussions regarding divesting some of our business assets and potentially some of our brands. As these transactions are completed, net proceeds will be used to pay down the debt we incurred in connection with the Seaguard ruling.”

While the CEO said they will look at all brands and businesses, he also told analysts that, “Klipsch and Onkyo continue to anchor our offering [in CE] and will be the driving brands in our Premium Audio Portfolio.”

It Happened Again

I have one final note about this strong presentation to analysts. When presentations by Lavelle and Shelton were both complete, the company opened up the call to questions from analysts.

And then it happened again, just as it had in the last earnings call, not a single analyst asked a single question. That is not a good sign.

A Sign From Investors

So what do investors think about Voxx’s performance? Remember, the company released their results after the close of markets on Wednesday. They held the earnings call with analysts Thursday morning where Lavelle laid out his plan for further restructuring and promised a return to profitability this year.

The value of Voxx’s stock dropped on Thursday, closing down a significant 6.69%. On a year-to-date basis through Thursday, investors in Voxx saw the value of their VOXX stock drop from a high of $10.85/share (January 9, 2024) to a low of $2.65/share (July 11, 2024) – a 75.6% drop in the value of their holdings! The average Nasdaq stock has seen its value increase 22% over that same period.

Learn more about Voxx by visiting voxxintl.com.

Leave a Reply