Company Blames Declines on ‘Negative Impact’ of United Technologies Unsuccessful Acquisition Bid

Nortek, Inc. stock dropped more than 9.3% in early afternoon trading Wednesday in the wake of a report released by the company after the close of business Tuesday showing results for their fiscal third quarter. With sales and profit declines in key business segments – as well as for the company overall – it appears that Wall Street analysts are growing tired of waiting for the promised benefits of the company’s multi-year restructuring program, begun four years ago.

Nortek, Inc. stock dropped more than 9.3% in early afternoon trading Wednesday in the wake of a report released by the company after the close of business Tuesday showing results for their fiscal third quarter. With sales and profit declines in key business segments – as well as for the company overall – it appears that Wall Street analysts are growing tired of waiting for the promised benefits of the company’s multi-year restructuring program, begun four years ago.

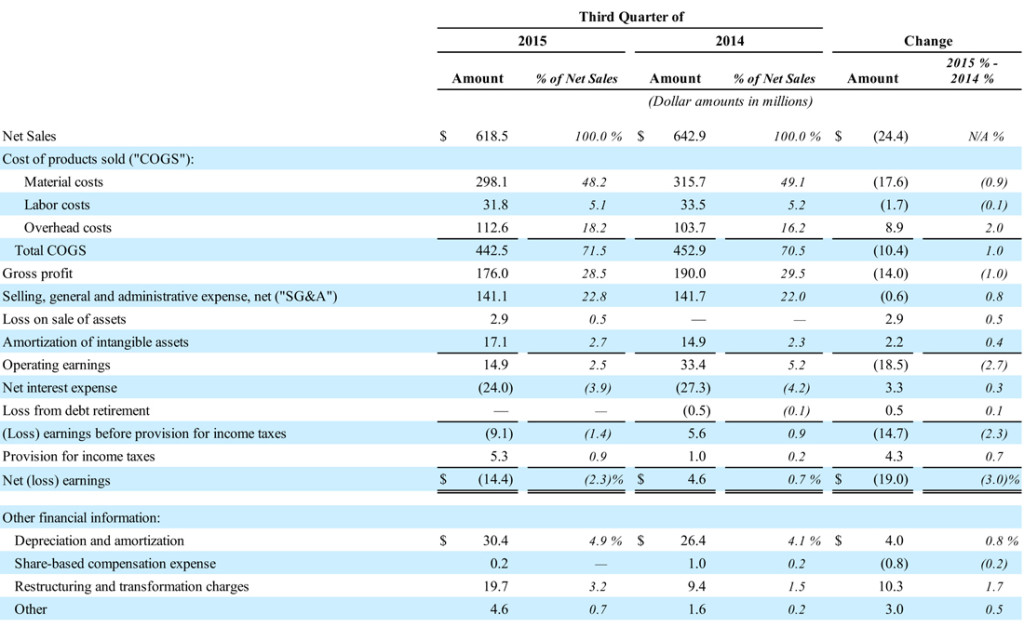

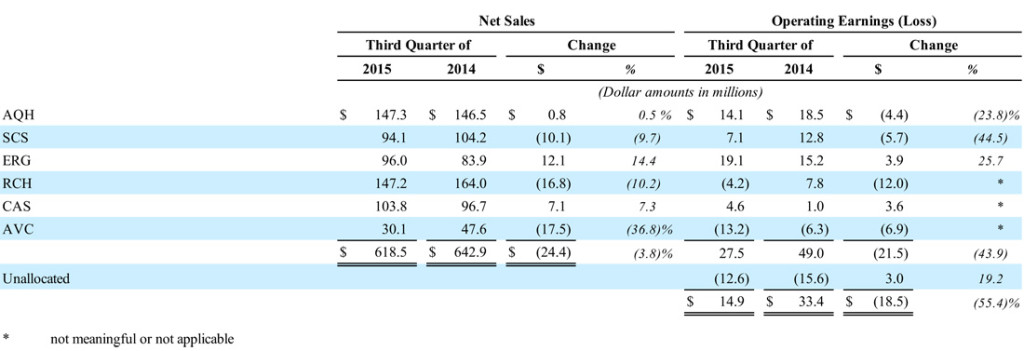

The company reported overall sales for the quarter of $618.5 million or 3.8% below the $642 million booked in the third quarter last year. The profit picture was even bleaker with a net loss of $14.4 million in the quarter this year as compared with a net profit in the quarter last year of $4.6 million.

Surprisingly, the AVC division saw sales drop an astonishing 36.8% to $30.1 million – well off the $47.6 million in the quarter last year – in the wake of the spin-off of TV One and the company’s exit from commercial AV businesses.

See more on this report and its troubling revelations…

Nortek is the parent company of Core Brands, a holding company of several significant custom integration brands, such as Niles, Elan, SpeakerCraft, Xantech, etc. In our analysis of Nortek’s previous second quarter report, we noted troubling red flags that had emerged. The smoke started rising in the fiscal first quarter, when the company disclosed that it was seeing a dramatic drop-off in orders from a key partner for its CAS (custom air solutions) segment – a “major semiconductor capital equipment customer.” It was, therefore, disappointing, but not a huge surprise that the company announced in their Q2 report that they will be forced to restructure the division, apparently not expecting that customer’s business to revive.

If the news from the company had stopped there in Q2, then they would probably have emerged unscathed. But then two nasty surprises were disclosed: 1) the RCH business unit (residential and commercial HVAC) had experienced a “temporary operational setback” related to some kind of shipment snafu from a third-party logistics provider that flattened sales and drove the unit to book a loss; and perhaps even more significantly, 2) the SCS (security and control solutions) segment, in the past the primary growth engine for the company, had unexpectedly booked both sales and profit declines of double-digit percentages. The company attributed this to “a difficult comparison” with the previous year.

Wall Street Reacts

The reaction to the Q2 report from Wall Street was swift and brutal – within a matter of hours, the company’s stock price had dropped 6%. Since the beginning of this year, Nortek has seen the total market value of the company decline by almost a third, as its stock price has dropped a total of 30%.

The reaction to the Q2 report from Wall Street was swift and brutal – within a matter of hours, the company’s stock price had dropped 6%. Since the beginning of this year, Nortek has seen the total market value of the company decline by almost a third, as its stock price has dropped a total of 30%.

There were other surprising disclosures in the previous Q2 report, though not necessarily as nasty. These other disclosures included the fact that AVC (audio, video, and control) – a separate reporting unit but not considered a core segment by the company – was still apparently challenged, showing sales declines and losses…although the losses had diminished.

The company announced it had decided to restructure AVC after receiving an unsolicited offer from the management of TVOne to spin-off the unit. So Nortek essentially gifted the division to management, as it received no money…or in corporate-speak…sold to management for “no substantial cash consideration received.” BUT, the company also announced that in addition to the TVOne spin-off, it would also: 1) merge Gefen into Core Brands; and 2) exit the commercial AV business.

The Story Continues in Q3

So turning to the third quarter report, we see more results – and learn more details – about rapidly unfolding events. Some may conclude that the situation is a deteriorating one, although company management would likely try to reassure you that they are on top of the situation.

“Nortek’s third-quarter net sales decreased 3.9% year-over-year, excluding acquisitions, divestitures and the impact of foreign exchange translation, and adjusted EBITDA, on the same basis, was down 3.7%,” said President and Chief Executive Officer Michael J. Clarke in a prepared statement. “Solid performance in our Custom Air, Ergonomics and Air Quality businesses was offset by lower sales and profitability in our HVAC and Security segments. During the quarter, we believe that the receipt of an unsolicited proposal to acquire the Company, related market rumors and activity related to the Company’s review of strategic alternatives had a negative impact on our business, employees and customers, primarily in our HVAC segment and to a lesser extent in our Security and Custom Air segments. We have ended all such activity, and we are working to put the uncertainties and the distraction related to this issue behind us. Rebuilding our momentum in the company, particularly in HVAC, will take some time. As a result, we have revised our full-year 2015 financial guidance.”

Besides sales and net profit declines in the third quarter this year, the company also saw declines in gross profit – both in dollars, and in percentage of sales. Operating earnings as well, declined from $33.4 million in 2014 to $14.9 million, or a drop of 55.4%.

[Click to enlarge]

What Investors Expected

These numbers are all well below what Wall Street was expecting. According to StreetInsider.com, the net loss of $14.4 million works out to a loss of $0.90 per share. Analysts were forecasting earnings per share of $0.52, meaning the final result was $1.42 per share below the consensus.

And although the company had booked Q3 sales of $618.5 million, the consensus forecast from analysts had expected Nortek’s Q3 sales to come in at $654.1 million…a significant miss. That makes this new Q3 result the second consecutive quarter where actual performance fell short of Wall Street’s expectations.

Four Segments Decline

But this was not all that had investors concerned, the new report seemed to show deterioration in the performance of more of the company’s business segments. Ironically, the CAS segment – the original culprit – appears to have rebounded based on their reorganization. But four other segments seem to face more or new challenges. These four segments – AQH (air quality & home solutions), SCS, RCH, and AVC – showed flat or significant sales declines…and all showed profit declines, with RCH and AVC generating operating losses.

In a deeper dive analysis by management on each of these segments, we learned things may be worse than originally thought. Especially in the case of SCS, the former golden child is starting to look more like a problem child.

A “Temporary Setback”?

In the second quarter of this year, the company revealed that it had experienced what it called a “temporary setback” relative to HVAC shipments during a prime time of the year in Spring. Apparently, the plan by the company to shut down Nortek-owned warehouses and facilities and outsource its logistics requirements didn’t work so well. This led to delivery problems and sales and profit declines.

Although the company didn’t go into great detail at the time, in their Q2 discussion, Clarke said “We immediately addressed the issue by bringing our internal HVAC distribution back online, and shipments increased substantially in June as a result.”

In-Sourcing: Reversing a Plan to Outsource Logistics

Whatever the specifics of their actions taken earlier this year to regain control, we were surprised to see further actions are apparently necessary. In their 10-Q report, Nortek reveals that – after previously closing down company-owned facilities and laying off their own logistics and distribution staff…the company is now buying three warehouses from their third-party logistics provider and bringing distribution back in-house. Not only that, but the company will employ the logistics employees as part of this initiative.

Whatever the specifics of their actions taken earlier this year to regain control, we were surprised to see further actions are apparently necessary. In their 10-Q report, Nortek reveals that – after previously closing down company-owned facilities and laying off their own logistics and distribution staff…the company is now buying three warehouses from their third-party logistics provider and bringing distribution back in-house. Not only that, but the company will employ the logistics employees as part of this initiative.

From their 10-Q – “In October 2015, it was determined that the Company would assume control of certain U.S. dedicated distribution centers that had been operated by a third-party logistics service provider since 2013.” [The deal is effective December 31, 2015.] “In connection with the assumption of the control of these distribution centers, the Company anticipates hiring approximately 200 employees who currently work at those centers for the third-party.”

The estimated purchase price is expected to be between $5.0 million and $7.0 million. In addition to that, the company will assume leases on the facilities that are expected to further cost them $4.3 million/$5.9 million/$3.3 million in 2016/2017/2018. There was no cost estimate given for the financial impact of the increase in staffing.

While the company asserts that taking care of the customers requires this move, it’s hard not to conclude that the ball was dropped on the front end of this deal by selecting a logistics partner that appears to have not been up to the task. Most companies run parallel systems until they are certain new processes will work properly.

#2 of a 1-2 Punch

The RCH HVAC business was also impacted by the recent news that United Technologies was in discussions to acquire Nortek. In a conference call with analysts, Clarke noted that the potential acquirer (he refused to say the name United Technologies) was a direct competitor to the company’s HVAC segment and the widely spread news of the potential sale of Nortek caused customers to pull back or even switch their business to other companies, like United Technologies.

Clarke acknowledged that the company lost “share of the wallet” with these customers. “The company mentioned in the [Wall Street Journal] article is one of our major competitors in HVAC,” Clarke said. “We haven’t lost any customers, but our ‘share of wallet’ was definitely affected.”

Clarke had to admit, “It will take some time to win back this business.” With this being the case, the HVAC business is expected to remain flat the rest of this year and on through the entire of 2016.

SCS – The Golden Child Becomes a Problem Child

Maybe even more concerning is the new details we’ve learned about the problems now vexing the Security and Control Solutions segment. In their Q2 report, management claimed the sales and profit declines were the result of “a difficult comparison to the prior year when we shipped a large concentration of orders in the second quarter of 2014.”

In Q3, SCS segment sales declined to $94.1 million or almost 10% below $104.2 million in the quarter last year. Operating earnings dropped as well, coming in at $7.1 million this year, a $5.7 million or 44.5% decline from the $12.8 million in operating earnings booked in the quarter last year.

Now management tells us that this drop in the third quarter is the result of declining orders by a couple of significant OEM customers. That, to us, seems materially different than blaming “a difficult comparison” as they did in Q2.

Remember that the company acquired Numera (a PERS provider) in June of this year to beef up the SCS segment. Numera is in these numbers, but “did not contribute any significant amount to net sales in the third quarter…”

“We continue to see a choppiness in orders with our largest OEM customers,” Clarke told analysts.

Management says they are trying to continue to diversify the customer base in the SCS segment. They also note that, other than the sales declines of the two large OEM customers, sales actually increased 4% with all other SCS dealers.

The company as well, is set to introduce a new product line, Go-Control 3 at CES. They have high hopes for this new line, which, Clarke told analysts, has a great pull-through to ancillary products with each console sold.

AVC – Company Says Residential Side is Showing Stability

On the face of it, AVC showed a surprising drop in sales with Q3 sales coming it at $30.1 million or 36.8% below the $47.6 million booked in the quarter last year. Operating losses increased as well, more than doubling from a loss of $6.3 million in 2014 to $13.2 million in the quarter this year.

The main reason for this decline is the spin-off of the TVOne business and the decision to drop commercial AV products. While the company does not provide visibility on the amount of business decline that will result from the decision to exit commercial AV, we do know the impact of the spin-off of TVOne.

For the entire fiscal year of 2014, TVOne booked sales of $20.3 million and generated an operating loss of $23.9 million. In the third quarter of 2015, the company said that TVOne had sales of $1.2 million and an operating loss of $3.4 million. In the third quarter of 2014, TVOne had sales of $5.3 million and operating losses of $1.4 million. The company also noted that the disposal of TVOne caused a loss of $2.9 million to be booked in the quarter this year.

Nortek also says that the decision to fold Gefen into Core Brands will cost somewhere between $8.0 million to $9.0 million in restructuring charges. These charges are mostly related to employee separation costs and asset impairment charges for discontinued products. During the third quarter of 2015, the company booked COGS and SG&A charges of approximately $6.5 million and $0.8 million respectively.

The AVC segment saw sales decline by a full $17.5 million in the third quarter. So if TVOne was only $1.2 million of that, we would have to assume the remainder was due to the decision to drop the commercial AV business. According to Michael Clarke on the conference call with analysts, the residential side of the AVC business “continues to improve year-over-year.” However, the financial tables in their 10-Q, however, give no specific data on this.

ERG

One significant bright spot for the company is the Ergonomic and Productivity Solutions segment which showed solid sales growth to $96 million, 14.4% higher than the $83.9 million booked in the quarter last year. Not only that, but Nortek says the segment had a EBITDA margin of 27% – an all-time record for the company.

According to Clarke, the ERG segment has been helped by aggressive new product development, as well as continuing strong demand for their existing sit-stand workstations and charging carts.

Q&A with Analysts Seemed A Little More Sober

Questions from analysts seemed to reveal some real concerns – especially with the drop in the HVAC business. More than the logistics issue, the concerns seemed to center around the loss of market position based on the negative impact of the news and rumors about the potential United Technologies acquisition.

When directly asked by one analyst how long it will take to rebuild the “share of wallet” the company has lost with HVAC customers, management couldn’t give specifics – saying that their best estimate is the the business will remain flat next year, equal to the volume experienced this year. It wasn’t clear if analysts were satisfied with this general estimate.

Multiple questions centered around the acquisition issue, with one skeptical-sounding analyst asking management to specifically state exactly how much and where the negative impact of this issue hit the business. “Uh, we haven’t disclosed that,” said CFO Al Hall after a pause.

“A lot of that is hard to quantify, you know the impact that it’s had in terms of our momentum,” said Michael Botelho, Nortek Vice President, Strategy and Investor Relations. “Obviously there were distractions in the marketplace. Our sales force was put more on the defensive rather than on the offensive. You know customers that Michael alluded to that have a choice of suppliers, sort of shifted their demand a little bit during that time horizon. We had to delay some strategic hires in the company because obviously it’s difficult to recruit during a period like that. We had to delay and postpone some strategy meetings that we had across the company that obviously set us up for [20]16.”

“It just takes you off your game,” Michael Clarke chimed in.

But the question was a specific query as to just exactly what was the hit to adjusted EBITDA in any manner from the potential buyout – an event that the management had pointed to as negatively impacting their results. So here again, a specific analyst question was met with a general management answer and general comments.

Other questions centered around the drop-off in the SCS segment – “Is this a competitive issue?” Clarke, in a meandering response, soft-sold the decline with the large OEM customers, saying they are in negotiations with these customers on new models, the relationship remains strong, so there is no cause for heightened concern.

Business Changes Forces Changed Forecast

With the impact of all of the emerging issues disclosed, Nortek management thought it prudent to restate their financial guidance for the year. While the revenue guidance only changed slightly, the projected adjusted EBITDA saw a more significant update.

Originally, the company forecast a sales range of $2.5 billion – $2.575 billion. This has now been changed to $2.5 billion to $2.515 billion.

However, the projected adjusted EBITDA was originally set for $290 million to $300 million. That range has now been revised to $270 million to $275 million. The company added that this new profit forecast includes a provision for $19.3 million to $19.8 million for “adjusted EBITDA losses on business that are being restructured and an Audio Video business entity sold.”

Leave a Reply