Walmart announced Tuesday that it has agreed to acquire Vizio, the high-value TV maker, for $11.50/share in an all-cash deal worth a total of $2.3 billion. Walmart announced the acquisition as part of its highly positive and optimistic presentation of the retailer’s fourth-quarter earnings. Walmart stock popped on the earnings report, more encouraged by its forward optimism of more growth rather than on the acquisition itself.

But Walmart plans to have this acquisition drive profit growth going forward.

Learn more on Walmart acquiring Vizio, including what is significant about it

Walmart (and Sam’s Club) is one of the country’s largest retailers of Vizio products, so the partners have had a long and productive relationship. When word leaked out last week that the two companies were having discussions of a potential merger or acquisition, Walmart and Vizio stock jumped last Friday.

The Parties Have Reached an Agreement

On Tuesday, the two partners confirmed they had reached an agreement, cementing the acquisition. And, as before, both company’s stock values shot up again on Tuesday, with Vizio’s stock jumping over 16%! Interestingly, Walmart has been clear from the beginning as to why they wanted to acquire Vizio – and it has little to do with their TVs.

What drew Walmart to Vizio is its SmartCast Operating System which allows users to stream ad-supported content for free on their Vizio TVs. The system is reported in their financials as Platform+ and has been a key element in the company’s growth.

Using Hardware for Revenues and Services for Profit

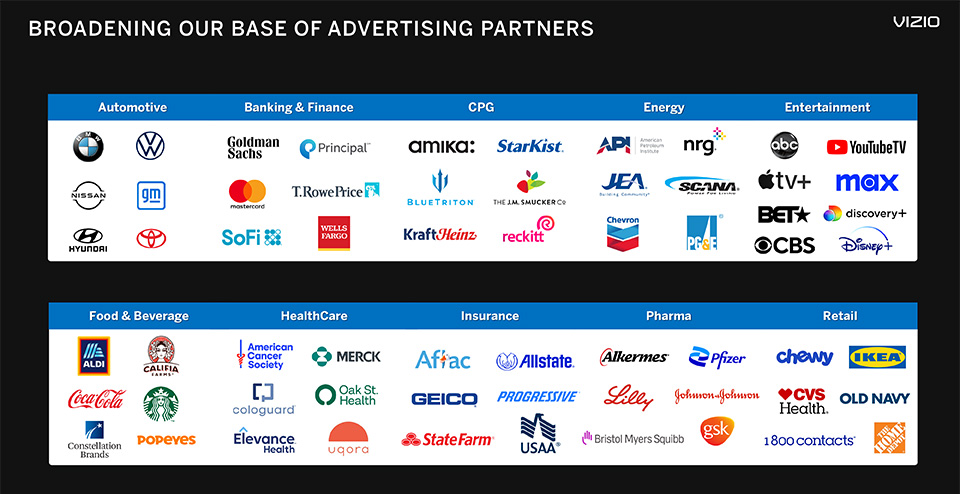

This is the new world today – hardware companies augment their results by pushing profitable services, such as ad-supported content, as part of a hardware sale. Walmart itself generates billions of dollars a year by offering advertisements on its Walmart Connect platform which pushes advertising on its in-store TV displays and on its website. Walmart Connect comes with substantially bigger profit margins than the groceries and clothing that the company sells.

And Platform+ is where Vizio is making money these days. In fact, you could say Vizio is pursuing a “give away the razors for free to sell the razorblades” marketing strategy. The company is losing money on its hardware and making its profits on Platform+. It seems crazy for a hardware company to take this route, but is the new way forward for many of them.

We believe VIZIO’s customer-centric operating system provides great viewing experiences at attractive price points. We also believe it enables a profitable advertising business that is rapidly scaling.

Seth Dallaire, Walmart U.S. Executive Viceo President and Chief Revenue Officer

Vizio Advertising Platform is ‘Rapidly Scaling’

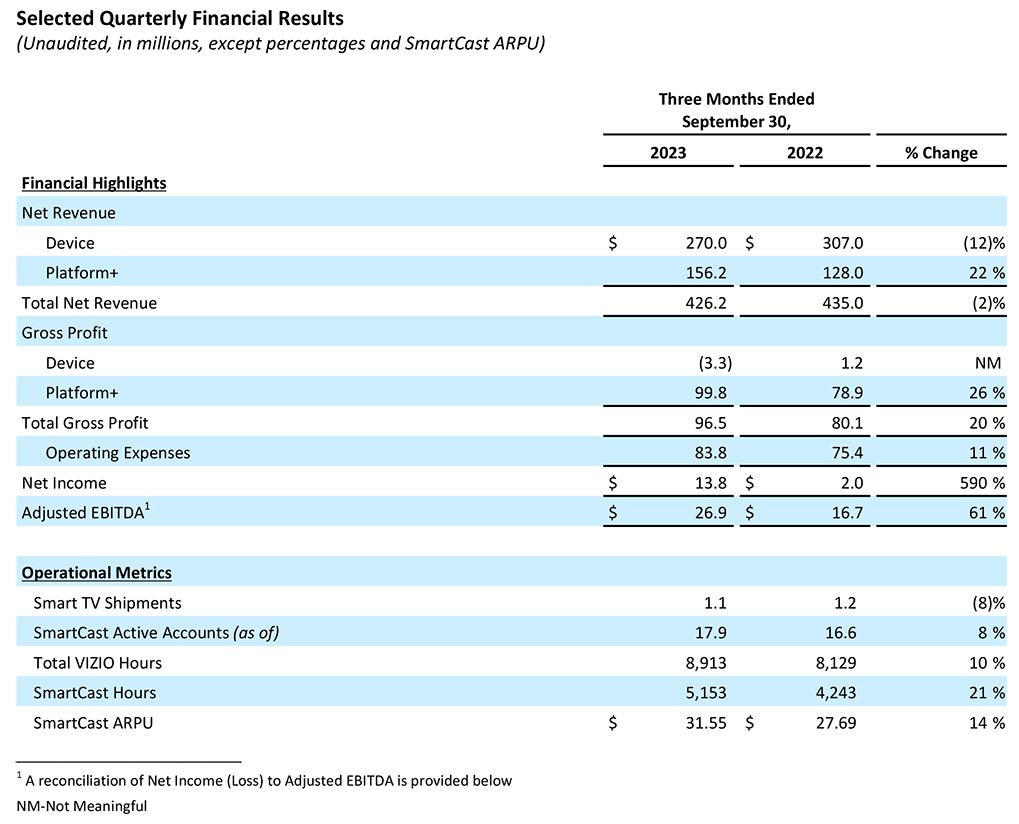

The table above shows Vizio’s third-quarter, fiscal 2023 quarterly earnings. It pretty clearly tells the story of just what about Vizio was so attractive to Walmart. Here you see Device Net Revenues (TV sales) declined 12% to $270 million (from $307.0 million LY) in the quarter while unit shipments of Vizio TVs declined 8% as compared to the same quarter last year.

Platform+ is the Key to Vizio’s Performance

But Platform+ saw revenues increase 22% to come in at $156.2 million versus $128.0 million in the same quarter last year. This is significant because Platform+ is quite profitable. Again, referring to the table above, you see the company reported a Gross Profit of -$3.3 million on that $270 million in hardware sales. But the Gross Profit on the Platform+ revenues was a positive $99.8 million – 26% higher than the same period last year.

The bottom line? The company booked a 590% increase in profits with a net income of $13.8 million in the quarter versus a net income of $2.0 million last year. As Vizio gets more of its TVs in the field, it’s financial leverage improves and results appear to be accelerating.

Financial ‘Flywheel’ Suggests Vizio’s Platform+ is ‘Rapidly Scaling’

Notice again that Vizio unit shipments of TVs DECLINED 8%, but at the same time, the number of SmartCast Active Accounts INCREASED 8%. Also, Vizio reported that the Smartcast ARPU (average revenue per user) also INCREASED to $31.55 or 14% higher than the ARPU of $27.69 in the same quarter last year.

This trend of growth in the number of accounts…along with growth in the value of each of these accounts is what is known in corporate-speak as their financial “flywheel.” And the pace of growth in both of these metrics is significant. Hence, Walmart’s comment that Vizio’s advertising is “rapidly scaling.”

Vizio is NOT a TV Company Anymore

In effect, Vizio is no longer a TV manufacturing concern. Rather, it is a media company that uses TV hardware as a sort of Trojan Horse to snag yet another outlet for its hidden army of push advertising. The more TVs they sell…even at a loss…the bigger their network and the bigger their network the more they can charge companies seeking to advertise there.

Walmart sees a strong synergy between Vizio’s SmartCast strategy and its own Walmart Connect program. Walmart Connect – which the company defines as a “closed-loop omnichannel media business” – grew 30% in fiscal 2024. One report said it has revenues of over $1.1 billion from Walmart Connect alone.

Taking Walmart Connect into the Home

I suspect Walmart is looking to further expand Walmart Connect out of its owned properties (store TV departments and company website) and take it to the next level…which is directly into the consumer’s home. And if I’m correct, that’s what makes this news so significant.

Learn more about Vizio by visiting vizio.com.

See all about Walmart by visiting corporate.walmart.com.

Leave a Reply