So the book is now closed on 2024 and…good or bad…it certainly was a consequential year for our industry. And while in the wake of all of that, we in the industry try to sort out what new challenges and opportunities 2025 brings…how did investors fare last year?

See how investors in select tech companies prospered (or didn’t) in 2024

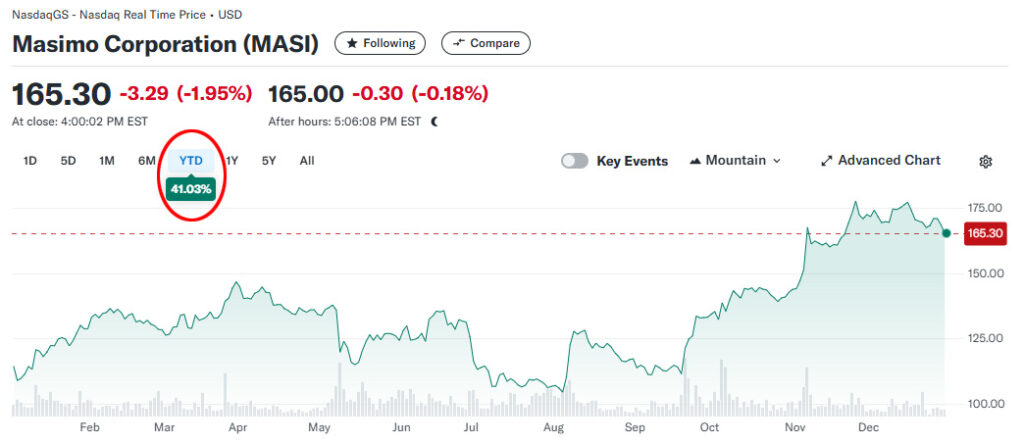

One of the more interesting events in tech last year was the cataclysmic shift when investors of Masimo rose up in concert with activist investor Quentin Koffey of Politan Capital Management to oust Masimo founder and CEO Joe Kiani from his own company. Investors were unhappy with the acquisition of Sound United which many viewed as a non-core business that amounted to an unproductive folly of a much-too-powerful CEO who ignored the needs of investors and allowed its stock to languish. The value of Masimo stock crashed when the Sound United acquisition was announced in 2022 and never recovered under Kiani.

This story is an epic one that serves to warn other founders and CEOs that you ignore your investors at your own risk. And as you’ll see below, the investor’s bet on Koffey appears to have paid off as it has turned the company’s stock around.

How Was 2024 for Select Tech Investors?

But how about other companies? How have investors in their stock fared in 2024? Below is a collection of some top tech companies that show the percentage gain or loss in the value of their stock in 2024. You might find this enlightening.

[NOTE: All financial data and charts are from Yahoo Finance. These charts were generated after the close of markets on December 31, 2024. Consequently, in the tables below, YTD Return and 1-Year Return are equal. Click to enlarge any chart or table]

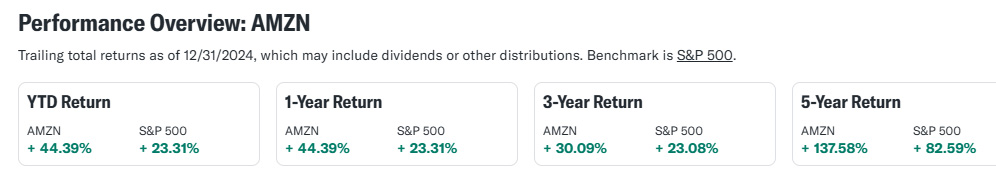

Amazon.com, Inc. (NASDAQ: AMZN)

First up is Big Tech player Amazon, which while it had its share of internal challenges and restructuring still turned in a good result for its investors. As you can see in the top chart in the red highlight circle, the value of Amazon stock rose more than 44% in 2024.

And if you refer to the table marked Performance Overview, you’ll see the company outperformed the overall S&P 500 market at the 1-Year, 3-Year, and 5-Year marks. A popular stock with investors…now you know why.

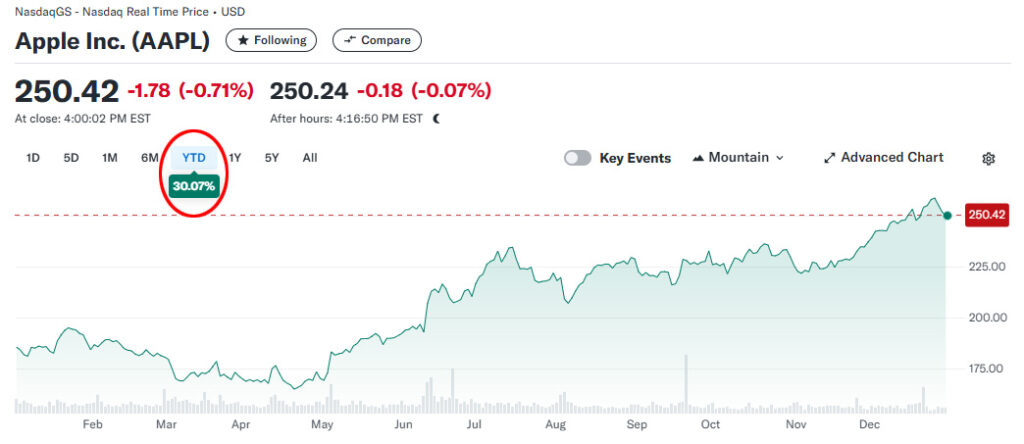

Apple Inc. (NASDAQ: AAPL)

Next, we have another Big Tech player, Apple one of the largest and most profitable companies in the world. Like Amazon, Apple was beginning to experience some serious challenges as the adoption of new models began slowing. This week, the company took the surprising step of discounting their phones in China to goose sales. But Apple has been helped by incorporating artificial intelligence into their lineup, helping them tap into the popularity of AI…which they call Apple Intelligence.

AI helped propel their stock upwards in 2024 and shares of AAPL saw its value climb 30.71% versus the 23.31% turned in by the S&P 500. So they beat the broader market by about 7.4% which while good, is slower then usual for the top tech brand. Also like Amazon, Apple beat the S&P 500 for 1-Year, 3-Year, and 5-Year results…with the 5-Year return being particularly impressive.

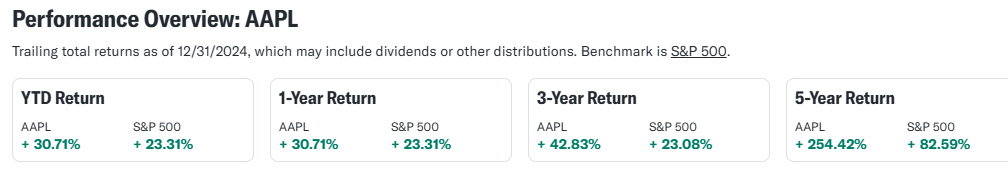

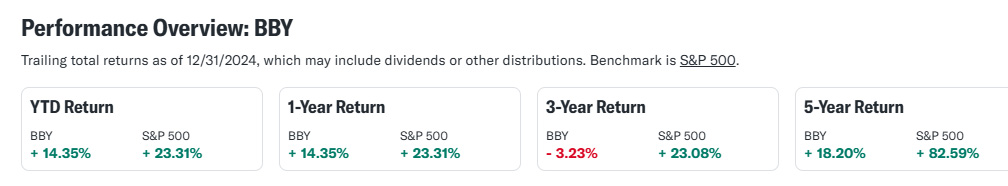

Best Buy Company, Inc. (NYSE: BBY)

Not generally considered “Big Tech”, but certainly one of the largest tech retailers in the U.S., Best Buy pulled out a gain of 9.61% in its stock value in 2024. Frankly, it was a bit of a squeaker for them. As you can see in their Performance Overview, even though the stock gained in value, Best Buy investors would have done better with their money if they had put their investment dollars in an S&P 500 index fund.

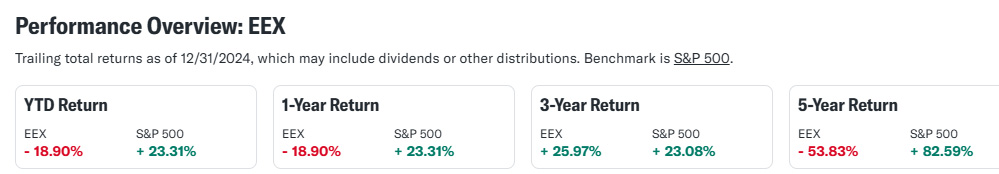

Emerald Holding, Inc. (Emerald Expositions) (NYSE: EEX) – Owner of CEDIA Expo, CIX, CEPro, and Custom Integrator

Emerald is still struggling to build momentum coming out of the COVID-19 pandemic. They saw the value of their stock drop by 19.4% in 2024 as investors reacted to the company’s struggling or failing initiatives, such as a reorganization of its media group.

As you can see in the Performance Overview, in two out of the three measured periods, Emerald stock value (EEX) not only didn’t beat the broader S&P 500 market but actually declined in value. However, the company’s stock value did beat the S&P 500 in the 3-Year Return, but only barely.

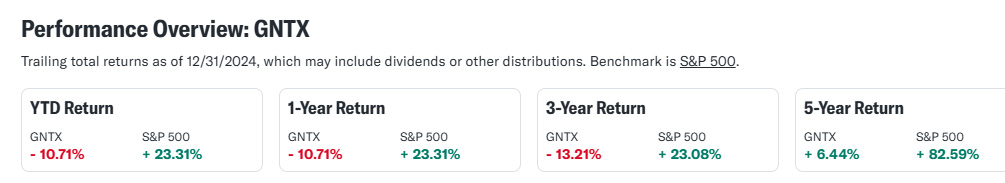

Gentex Corporation (NASDAQ: GNTX) – New Parent of VOXX Int’l, Premium Audio Company, Onkyo, Integra, and Klipsch

Gentex Corp. is an auto parts manufacturer that in December 2024 announced it would acquire VOXX Int’l, Premium Audio Company, Onkyo, Integra, and Klipsch. As you can see in the stock chart here investors don’t seem too excited about it. In 2024, the value of Gentex stock has dropped 12.03%.

According to its Performance Overview, GNTX stock did increase in value in the 5-Year reading, but only by 6.44%…well below the S&P 500’s growth of 82.59%. And their stock value declined both in the 1-Year and 3-Year readings.

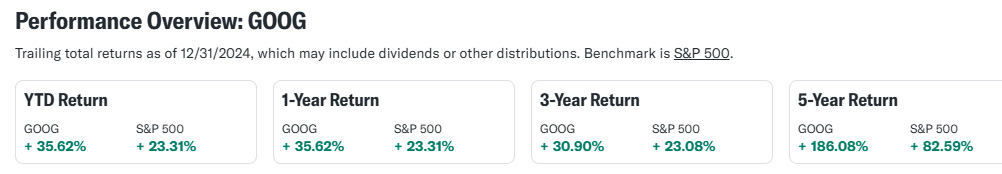

Alphabet, Inc. (Google) (NASDAQ: GOOG)

Another Big Tech player, Alphabet Inc., the company better known as Google, has seen its stock perform surprisingly well, even though it is dealing with regulatory challenges in the U.S. and Europe. The key for them is that they have aggressively pursued AI technology, with is an incredibly hot buzzword with investors right now. In 2024, the value of Google stock rose 35.13%.

In the longer-term Performance Overview, Google stock has risen in each of the three periods measured – and done so by a comfortable margin over the comparable S&P 500 rate.

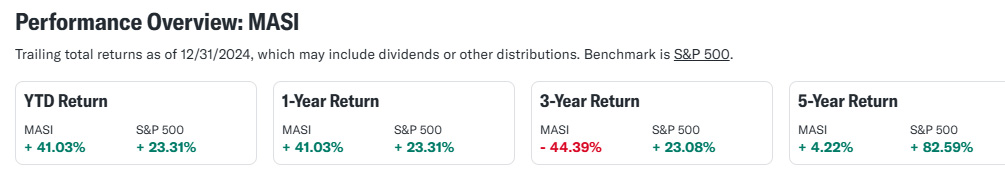

Masimo Corporation (NASDAQ: MASI) – Parent of Sound United

What a story Masimo Corp. was in 2024. And it is a story that you can follow by looking at the stock chart above. In 2022, Masimo, a professional medical products maker acquired Sound United, parent of several great audio brands, such as Denon, Marantz, Bowers & Wilkins, Polk Audio, and more. Investors didn’t like the deal and Masimo’s stock tanked, with its stock value remaining historically low for the next two years. Activist investor Quentin Koffey of Politan Capital Management bought in and agitated for change in the makeup of the Board of Directors – which he accomplished in September.

One look at the chart shows you how investors felt about the changing of the board and the exit of former CEO Joe Kiani. The annual stockholders meeting was held at the end of September and investors voted in a majority of Politan candidates for the Board (and Joe Kiani resigned). You can clearly see that the result of these changes was the stock had a great end-of-year run and the value of MASI shares rose 41.03% in 2024 – quite a bit better than the 23.31% of the S&P 500. Looking at the Performance Overview, you can see that 2024 was a turning point, as the stock performed poorly compared to the S&P 500 in 3-Year and 5-Year gains.

Meta Platforms, Inc. (Better Known as Facebook) (NASDAQ: META)

Facebook, another Big Tech player is another favorite of investors and it’s clear why when looking at the data above. The company has reinvented itself multiple times and has its own in-house AI technology that promises big things for the future…at least in investors’ minds. In 2024, the value of META stock has increased 66.05%, well over the S&P 500 reading.

As the Performance Overview showed, 2024’s performance was not a fluke – the company’s stock value gains have consistently outperformed the S&P 500 result.

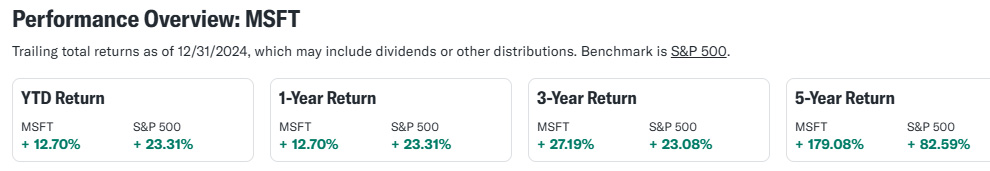

Microsoft Corporation (NASDAQ: MSFT)

Microsoft is another Big Tech company that has found favor with investors thanks to strong growth in both its cloud services division, and its investment in AI with its partnership with OpenAI’s Chat GPT-3. It was a strong double barrel of popular and potentially industry shifting technologies in which it would lead.

In 2024, the value of MSFT stock increased a respectable 12.09%. If that seems too modest, it was probably due to increased competition by strong players in the AI technology game. But Microsoft has shown positive gain in stock value over each of the 1-Year, 3-Year, and 5-Year periods of analysis.

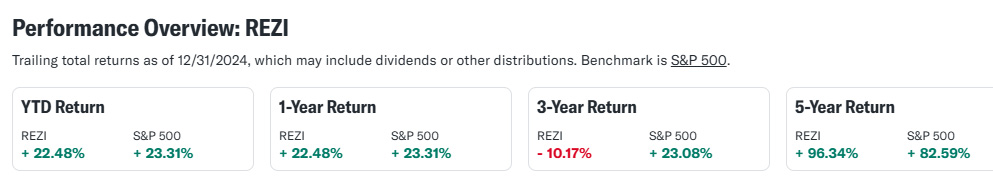

Resideo Technologies, Inc. (NYSE: REZI) – New Owner of Snap One

Resideo Technologies (NYSE: REZI) is the new owner of Snap One, a major player in a broad range of products, primarily for the custom integration segment. Resideo has two divisions – P&S (Products & Solutions) and ADI. Snap One is now part of the ADI division which increases its distribution footprint. ADI has always had more success in the security segment than AV and since Snap One was just beginning to dip its toes in the security product segment, this appears to be a prime connecting point for the new kid in school.

In 2024, REZI stock value grew by 22.48%, less than the 23.31% growth rate in the broader S&P 500 stock index. While that is not particularly impressive, the REZI stock value in the 3-Year period declined by 10.17%, way worse than the S&P 500 gain of 23.08% in the period. On the 5-Year analysis, REZI stock grew by 96.34%, about 14% better than the S&P’s growth of 82.59%.

It is still early days, but the jury is still out as to whether Resideo’s acquisition of Snap One will pay off for the company.

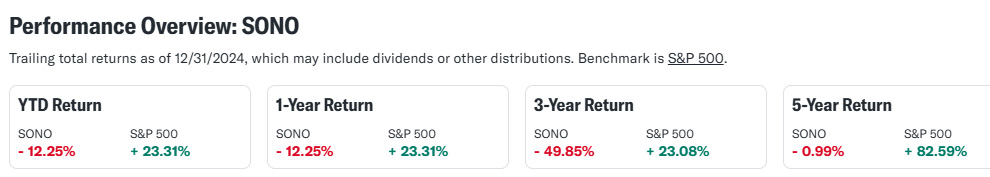

Sonos, Inc. (NASDAQ: SONO)

Longtime Strata-gee readers know I have been following the rise and fall of Sonos for a few years now. The company, caught between the pincers of a disastrous app rollout and declining rates of consumer adoption for new products, is in a dangerous place right now. Its actions this year have served to stress its relationship with consumers nearing the breaking point…and if the company’s efforts to “right the ship” don’t begin to bear fruit soon, we may see a shakeup at the company.

Investors too are showing signs of losing patience with company management. In 2024, the value of SONO stock dropped 12.25% by the end of the year while the S&P 500 index grew by 23.31%. Ouch! But looking to the longer performance of SONO stock, we see it has consistently underperformed the average S&P 500 stock: 3-Year return of -49.85% vs +23.08%…5-Year return of -0.99% vs +82.59%.

Sonos like to call itself the Sound Experience company…but lately, consumers say they have been experiencing a decidely sour sound from the company.

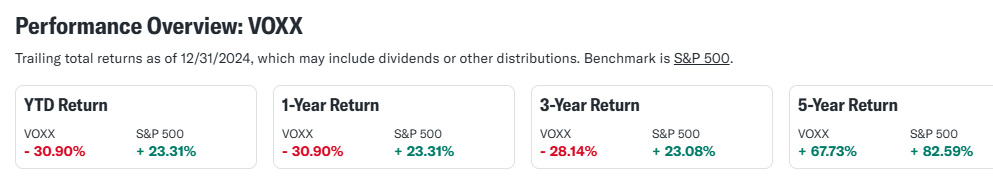

VOXX International Company, Inc. (NASDAQ: VOXX) Owner of Premium Audio Company, Onkyo, Integra, and Klipsch

Yes, Voxx International Corporation (NASDAQ: VOXX) is in the process of being acquired by Gentex Corp. (see their performance noted earlier in this post), but until that deal is finalized, which isn’t expected until sometime in the first quarter of 2025, Voxx stock is still trading. And how did Voxx investors fare in 2024? Not so well, I’m afraid. The value of VOXX stock declined in 2024, losing 30.9% of its value throughout the year.

However, if you turn to the Performance Overview, you’ll see that VOXX has not been performing well in any of the measured periods. For example, the 3-Year return on VOXX stock dropped 28.14% compared to growth of 23.03% for the overall S&P 500. And even though Voxx’s stock value did grow in the 5-Year analysis, up 67.73%, this result was well under the 82.59% increase in value of the S&P 500.

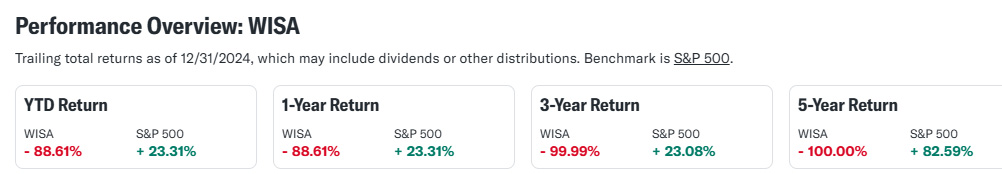

WiSA Technologies, Inc (WISA)

The first thing an emergency room doctor does with a patient just wheeled in from an ambulance is to feel their wrist to see “if there’s a pulse.” Maybe someone should do that with WiSA Technologies Inc., (NASDAQ: WISA), a developer and licensor of spatial, wireless sound technology. Looking at the company’s stock chart above for the back half of the year, you might think that it shows a company without a pulse – a flat-liner. But here’s a surprise, in the last quarter of 2024, WiSA has announced two acquisitions. Yet when I look to see how investors reacted to that news in that October – December period…I still don’t see a pulse.

Stepping back to look at the big picture, the value of WISA stock dropped a disturbing 88.61% in 2024. Further pulling back to the view at 30,000 feet, we see that the company’s stock has declined in each of the three periods of analysis: 3-Year off 99.99%…5-Year off 100.00%.

Ouch!

On to 2025!

There is a clear division here between the Big Tech companies who all had a great 2024 and the non-Big Tech (NBT) companies who had decidedly mixed results. Now we move on to 2025…perhaps a better year for the NBT players?

Leave a Reply