I recently received the final data on SVOD (subscription video on demand) market share for 2024 for the top streaming service providers. This data came from JustWatch, an international streaming guide with 17 million monthly users in the U.S. and 55 million monthly users in 150 countries worldwide.

Who’s leading the race? Read on…

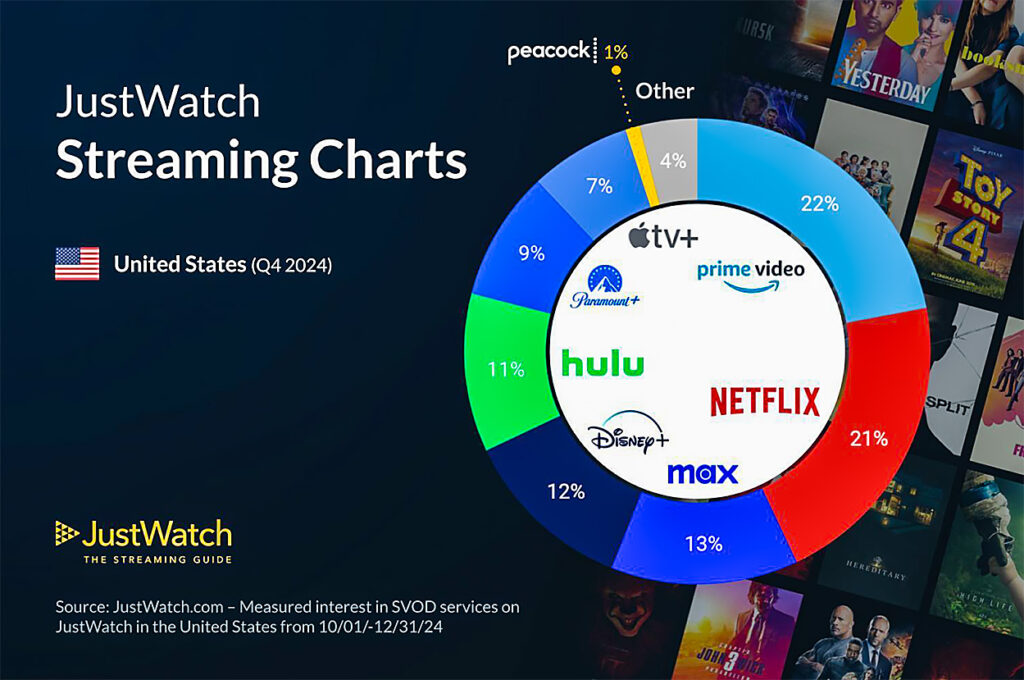

According to this latest data, compiled during the 4th quarter from October 1 – December 31, 2024, the most popular streaming service in the U.S. is Amazon Prime Video, with 22% of the total market share. Almost equal is the venerable Netflix, just 1% behind at 21% share.

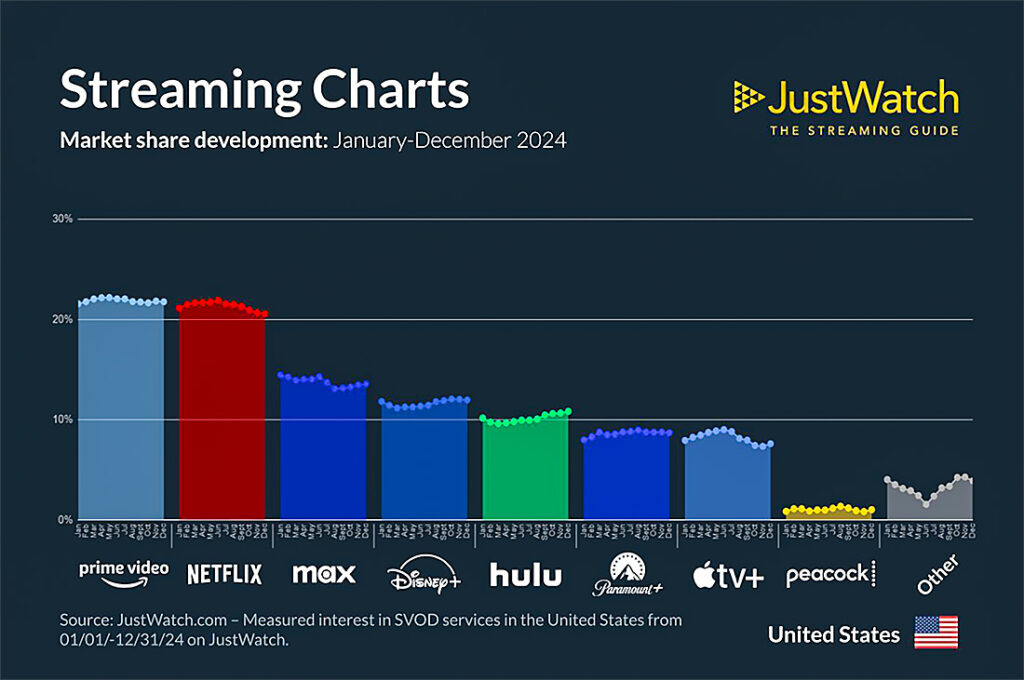

According to JustWatch, Netflix actually gained ground on Amazon Prime Video during 2024. These two market leaders are followed by Max at 13%, Disney+ at 12%, and Hulu at 11%.

There is Some Jockeying Between Services Going On

There is definitely some jockeying going on with market share subtly shifting over time. Hulu is said to have shown steady growth throughout 2024, challenging Max for 3rd place. But again, according to the data, Disney+ struggled to gain traction despite a lot of effort by the company.

The researcher noted that the “Other” category experienced a noticeable rise in 2024. This data appears to reflect an increased interest in some of the individual streamers grouped in this collective number of largely niche providers.

Annual Pattern Follows the Q4 Results

Looking at the data in an annualized format [see chart below], we find that the pattern in Q4 is pretty much a reflection of the annual positioning. It is interesting to note that Peacock, the NBC venture, barely eeked out a 1% showing. They can’t be happy with that!

Like many business segments, streaming services were high-flying during the pandemic but have struggled to maintain momentum post-pandemic as more and more providers jumped into the game, increasing the competition. At the same time, as the pandemic faded, consumers began picking up their out-of-home activities, and demand began to falter.

As a result of all of this, many streaming service owners have resorted to combining with other services to create greater content “pull.” However, trying to keep content and service costs in line is a challenge.

Original Content – The High Cost of Competing for Greater Share

And thanks to the strategy of powerful players like Netflix, the “O.G.” of streamers, who fought off competition by investing in a massive catalog of compelling and popular original content, keeping costs in line is getting tougher and tougher for the more niche players.

Amazon has traded on the popularity of its Prime membership program. However, there are some signs that even this massive program is struggling to maintain momentum as prices increase and the package of included services gets trimmed.

Data Collected from App Use

JustWatch data is collected and combined from its website, TV, and mobile apps. These apps offer a large directory of content that users can use to create a “watchlist” and then click through to go see that content on available service providers.

See more about JustWatch by visiting JustWatch.com.

1. Which live tv streaming service leads the way ? You-Tube Tv ? FUBU/HULU ( merger ) ? DirecTv Stream ? Sling ? Disney ? Philo ? Anyone new ?

2. Considering you are part of the AV Market – Of these Live tv services which one provides the most 4K /HDR Content ?

3. Considering you are part of the AV Market – Of these Live tv services which one provides the most Dolby Digital 5.1 and Dolby Atmos Content ?

4.. Dont be fooled by provider’s like You-Tube Tv claims they have 4K content when in reality it is very limited content unless this changes in 2025

5. Which provider’s allow for multiple house holds ?