Earlier this month, WiSA Technologies released its Fiscal 2023 third-quarter earnings report and it was not a pretty picture. Still, company CEO Brett Moyer struck an optimistic tone and said its results were “better than expected.” Then he shifted attention to a focus on the company’s latest WiSA E technology which he suggests is making huge positive gains that point to a brighter future.

Can investors ignore the messy present financial condition…to hold on for a – maybe – brighter tomorrow???

Is WiSA delusional…or on to something?

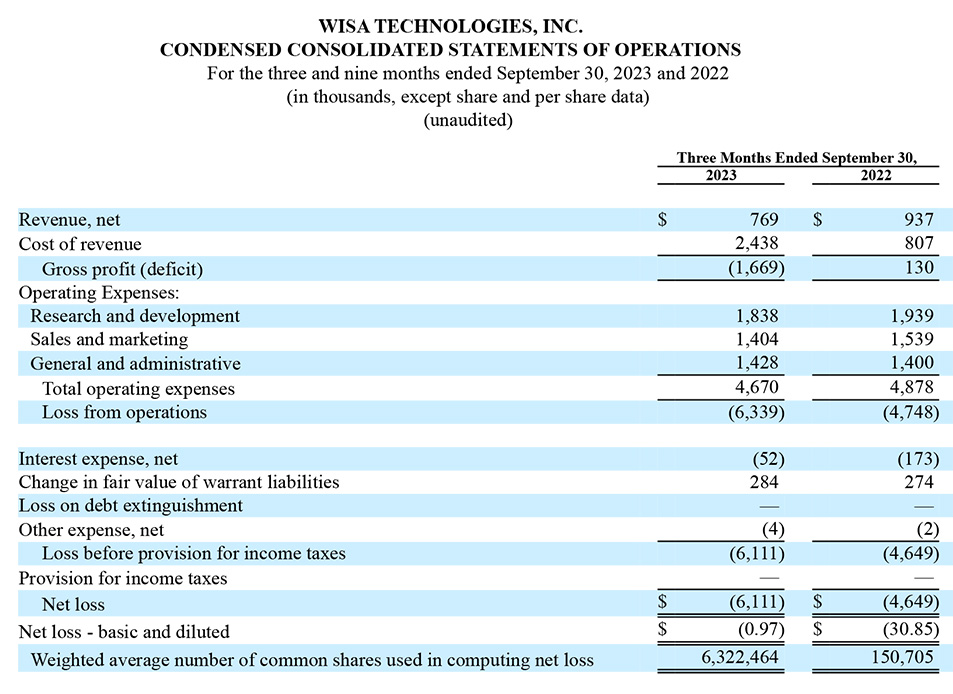

WiSA Technologies, Inc. (Nasdaq: WISA), a developer and licensor of spatial, wireless sound technology, reported Q3/2023 results this month and I have to tell you, it was one of the most unusual press releases and investment analyst conference calls I have ever participated in for a public company. What was unusual, you ask? Well, for one thing, there were no actual financial tables or reports included in the press release on the Q3 earnings. Typically, at least a summary financial report is included…and many public companies include their full financial statements.

Very Little Contemplation of Financial Performance

Instead, the company started by discussing its non-financial business achievements over the last ninety days. In the entire four-page press release announcing the earnings report, there were only three bullet points on financial performance. These bullet points were:

- Q3 2023 revenue was $0.8 million, down 18% from $0.9 million in Q3 2022 and up 81% from $0.4 million in Q2 2023.

- Q3 2023 gross margin as a percentage of sales was negative 217%, compared to 14% in Q3 2022 and negative 47% in Q2 2023. The decrease in gross margin as a percent of sales is mainly attributable to a $1.4 million increase in inventory reserves primarily attributable to our HT semiconductor chips, lower sales volumes in relation to the fixed portion of costs and lower pricing of our Consumer Audio Products.

- In July 2023, the Company received net proceeds of approximately $0.6 million in connection with a warrant inducement. In September 2023, we secured a term loan in the principal amount of $650,000 from a related party.

Moyer, ‘Today, We Will Not Be Going Over the Financials’

This construction of the formal earnings announcement caught my attention. Was it that the company wanted to downplay the financials? This unusual, underplaying of the financials theme continued with the scheduled conference call for investors, which was less than 30 minutes long – a relatively short time for these types of presentations. But the call was remarkable for how it started.

After the usual regulatory announcements, CEO Moyer starts by saying: “Thank you, ladies and gentlemen, for joining the call today. Today, we will not be going over the financials – we filed a 10-Q last night. If you have questions on financials, I’ll take those during the Q&A.”

A First for Me That Doesn’t Feel Very Transparent

I truly think that this is a first for me – a conference call for investors in which financials will not be discussed. It didn’t feel like WiSA was trying to be very transparent with its investors. And while Moyers offered to answer their financial questions, such questions would only likely be coming if investors had discovered the 10-Q filing the night before and read it. These kinds of filings can be quite long – WiSA’s is 43 pages long.

A look at the financials may explain why the company chose to ignore them to try and shift the focus on a series of recent events that it feels portends a brighter future. Before I get into that, I feel obligated (even though WiSA didn’t) to provide an overview of the company’s fiscal 2023/Q3 results, which is the 90-day period that ended September 30, 2023.

Let’s Go to the Numbers; Company Reports a Slow-Down in Consumer Spending

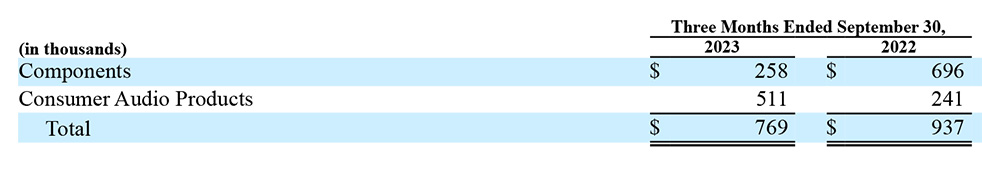

First, you need to know that WiSA considers itself an “emerging technology” company that generates revenues through sales of components to third-party brands to be incorporated into their products…and through consumer audio products of its own. This selling of their own speaker products under the Platin Audio brand seems like something that WiSA Association members – with a few speaker manufacturers – might find as a conflict of interest.

The company reported that Net Revenues came in at $769,000, which is $168,000 or 18% lower than the net revenues of $937,000 in the same quarter in fiscal 2022. The company says the overall revenue decline is due to “a slow-down in consumer spending on consumer electronics…”

‘Component’ Sales are Down While ‘Consumer Electronics’ Sales are Up

WiSA further provided a disaggregation of this overall number to report both component sales and consumer electronics sales. Component net revenues in the quarter were $258,000, which was down $438,000 or 63% as compared to net revenues of components of $696,000 in the same quarter last year. However, net revenues of Consumer Audio Products – a new category for them – in the quarter came in at $511,000 which was up $270,000 or 112% over net revenues of $241,000 last year.

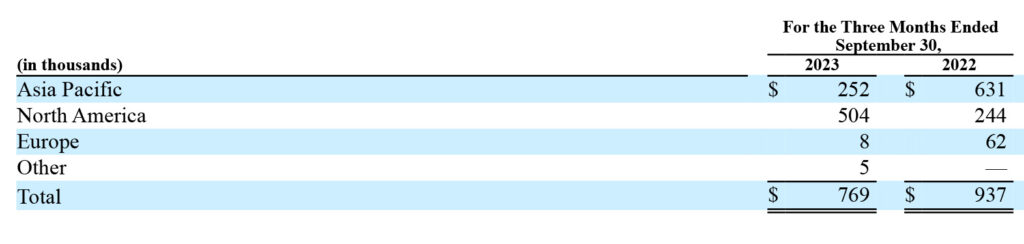

On a geographic basis, the company tracks its global sales in four regions – Asia Pacific, North America, Europe, and Other. Both the Asia Pacific and Europe regions saw revenue declines, while North America and “Other” showed revenue increases, although Other only had revenues of $5,000.

A $1.4M Writedown of Previous Technology; Gross Margin Becomes a Gross Deficit

Looking at the numbers, as I mentioned above, we see a significant drop in overall revenues accompanied by a massive increase in Cost of Revenues which directly impacted Gross Margin (Deficit). Cost of revenues jumped from $807,000 in the quarter last year to $2.438 million this year. That is a massive increase of $1.631 million causing fiscal 2022/Q3 gross margin of $130,000 to fall to a gross deficit of $1.669 million in the quarter this year. According to WiSA, this gross deficit is due to “a $1.4 million increase in inventory reserves primarily attributable to our semiconductor chips [ED: a reference to its now outdated legacy HT (Home Theater) series chip technology], lower sales volumes in relation to the fixed portion of costs and lower pricing of our Consumer Audio Products.”

Gross Margin (Deficit) as a percent of sales was -217%.

A Reduction of Expenses in Some Categories

Other than getting hit with a charge to earnings to offset a changeover from its previous now-devalued technology, the company has been successful in reducing other costs, including Research and Development, and Sales and Marketing. R&D costs for Q3 were $1.838 million versus $1.939 million in the quarter a year ago. This is a 5.2% cut in R&D costs which the company said was mostly due to lower salary & benefit expenses and reduced use of outside consulting. Sales and marketing expenses were $1.404 million in the quarter this year, an 8.8% reduction from sales & marketing costs of $1.539 million in the Q3 of fiscal 2022. This reduction was largely due to lower website and advertising fees.

On the other hand, General and Administrative expenses increased this year. These costs came in at $1.428 million or 2% over the general and administrative expenses of $1.400 million in the same quarter last year. The company noted that these expenses were the result of higher investor relation expenses, partially offset by lower legal fees.

A Net Loss of $6.111M

The Net Loss for the quarter is $6.111 million or 31.5% greater than the net loss of $4.649 million in the same quarter the previous year.

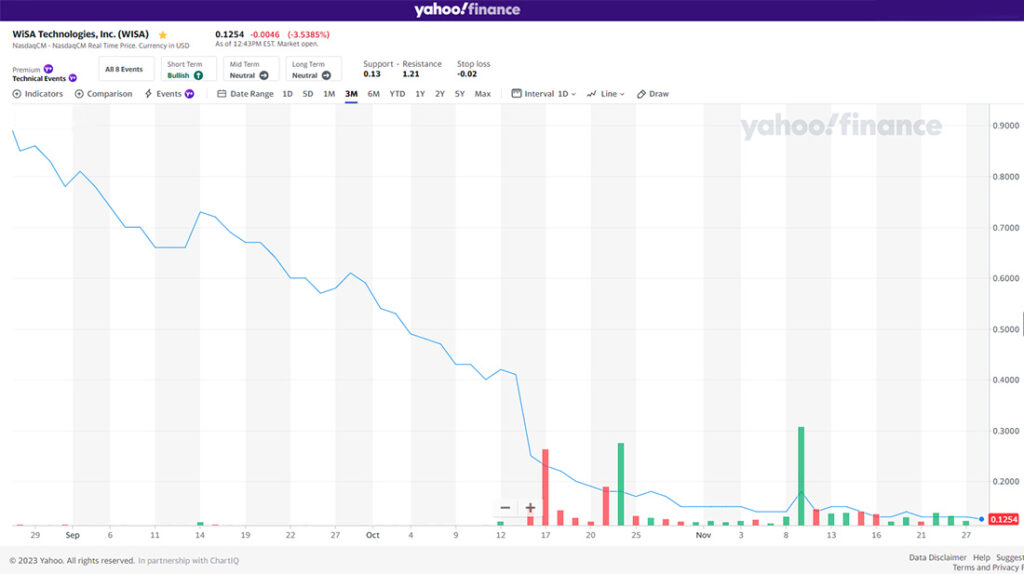

WiSA Technologies went public in 2018 and has never made a profit. Over the last ninety days (to November 28), the company has seen the value of its stock drop from $0.93/share to $0.1318/share – a precipitous loss of 85.8% in value for WISA shares.

Other Troubling Data

Cash Burn – As of September 30, 2023, the company had $200,000 in cash on hand. For the nine-month year-to-date period, the company had burned through $12.1 million in cash. Accordingly, “the company will need to raise additional funds by selling additional equity or incurring debt.”

Disparity to Norms – Three of the company’s customers account for 40%, 28%, and 21% of net revenue. Business schools teach you that you should never have any one customer account for more than 10% of your revenue. Not only that, but the company has two customers that account for 78% and 11% of their entire accounts receivable. I don’t know what financial professionals would say about that, but it can’t be good.

Doubts About Ability to Continue As A Going Concern – WiSA disclosed that it will need to raise additional funding through the issuance of either equity or debt as its revenues do not yet cover its cost of operations. It is never guaranteed that it will be possible to raise funds. For this reason, they disclosed that there is “substantial doubt about the Company’s ability to continue as a going concern.”

New Nasdaq Out-of-Compliance Notices

The company has also revealed that on October 5, 2023, it received a written notification from Nasdaq that it was out of compliance with the exchange’s requirement of a Minimum Bid Price of at least $1.00/share. Shares in WISA had been well below $1.00/share for more than 30 business days. If WISA was kicked off the Nasdaq exchange, it could greatly impede the company’s ability to raise funding, something that has been instrumental in keeping the business afloat with a very negative cash flow. Nasdaq has given the company 180 calendar days to April 4, 2024, to remedy this violation and reacquire at least $1.00/per share stock value.

Then, on November 17, 2023, WiSA notified the Securities and Exchange Commission (SEC) that it had received yet another notice from the Nasdaq Listing Qualifications staff notifying the company that it was also out of compliance with Nasdaq Listing Rule 5550(b)(1) which requires companies to maintain a minimum stockholders’ equity of at least $2,500,000. In fiscal 2023/Q3, WiSA reported its stockholders’ equity was a negative $885,000, or in other words in deficit.

Maybe This is Why Moyer Chose to Discuss WiSA E…Instead of Financials

Perhaps it’s for all of these reasons that Moyer chose to ignore the financials and talk about what is going well for the company. Mostly, he wanted to talk about WiSA E.

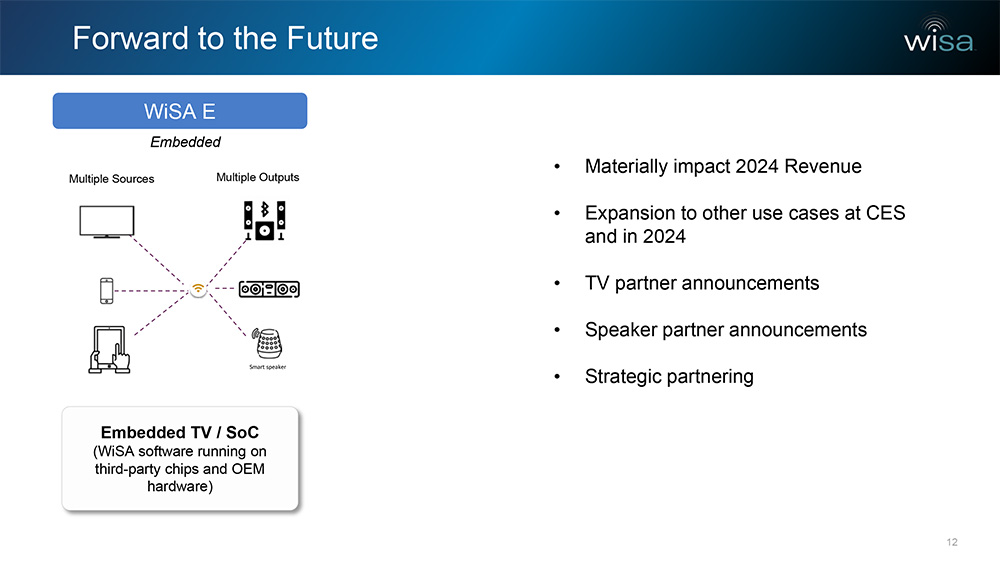

The company’s latest technology, WiSA E operates in the 5GHz portion of Wi-Fi and can transmit 8 channels of 48kHz PCM audio with low latency and high speaker-to-speaker synchronization. It is the holy grail that allows consumers to easily set up an entire home theater surround sound system with 0 (zero) speaker wires. It works in either a traditional or Dolby Atmos environment.

WiSA E Launch Milestones Achieved

The company has high expectations and says that the feedback they’ve received from manufacturers they’ve shown the system to has been very positive. Moyer showed investors and analysts a presentation during the conference call that showed in the last 90 days it had achieved several milestones in the rollout of WiSA E, including…

- Presented WiSA E in more than 60 meetings with more than 30 companies

- 13 display companies (both TV and projector) have studied the system

- 7 display brands went to the next step of reviewing a formal licensing agreement, and more are expected to follow

- 85 development boards have been shipped to customers

WiSA Excited to Sign Up Display Companies

Moyer is particularly enthusiastic about the display customers – a huge channel that offers a ton of opportunity. During the conference call with investors and analysts, Moyer predicted that two display partners will come on board in 2024, with many more expected in 2025. He says all customers are excited about the technology, including its speaker manufacturing members, and WiSA E should make a contribution to 2024 revenues starting in mid-year with much greater revenue in 2025.

WiSA E is flexible and can be implemented in any level system at a very low cost. In fact, Moyer revealed that display makers can obtain it with $0.00 licensing fees. Apparently, the company feels that by WiSA underwriting the signing of display companies, this will drive the greater WiSA ecosystem and be worth it in the end. They also feel that this will open up the technology to a more mainstream customer who buys an entry-level TV, for instance, and then pairs it with a compatible soundbar for a much better sound experience than the TV’s speakers alone.

Good Times are Coming(?)

The company is predicting a big CES for WiSA, saying WiSA E will be demonstrated on a Tier 1 TV brand at the show. They also claim to have a full dance card of meetings with new potential licensees scheduled for the event.

While I don’t doubt Moyer’s sincerity in his enthusiasm, it seemed like he was telling investors, in effect, to ignore the financial noise and just hang in there…good times are coming. But he’s been selling the future good times to WiSA investors for years. So far, the promised future good times just haven’t come.

Might it actually happen this time???

Learn all about WiSA Technologies by visiting wisatechnologies.com.

See WiSA’s consumer electronics products under the Platin Audio brand at platinaudio.us.

Leave a Reply