BREAKING NEWS

Yamaha Corporation announced yesterday in Japan that its Board of Directors has ordered a major restructuring of the company’s domestic operations – in one case merging eight separate operating subsidiaries into one. The company has also released results for FY2013 through the third quarter ending December 31, 2012 and revised its annual forecast downward from a profit to break-even as a result of extraordinary charges related to the restructuring as well as sales and profit declines.

See details on the dramatic steps Yamaha’s Board is taking to try and improve efficiency & profitability…

In the wake of a meeting of Yamaha Corp. Board of Directors, several actions were laid out to try and drive efficiencies to improve profitability. In particular, the company has announced a major restructuring of its domestic Japan operations, mostly in the musical instrument and AV/IT sales and marketing side of their business. Given that the musical instrument division is their largest, the company places great focus on it.

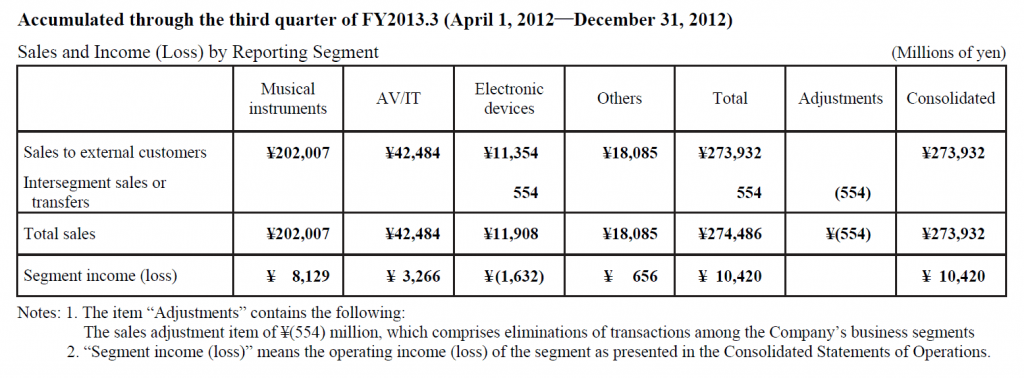

At the same time, the company also released the FY2013 results for the nine month period through the third quarter which ended December 31, 2012. Although, like all Japanese companies, Yamaha struggled with a negative currency exchange rate, it nonetheless managed to show modest growth in sales – up 1.2% to ¥273.9 billion ($3.4 billion) versus ¥270.6 billion in 2012. Operating income, on the other hand, declined 5.1% to ¥10.4 billion ($130 million) versus ¥10.9 billion in 2012.

A gain through the first nine months will be wiped out by extraordinary charge…

The company, however, showed a net income gain of 63.6% to ¥4.5 billion ($56 million) as compared to a net profit last year of ¥2.7 billion. Ordinary income also showed a small gain of 1.9% year-over-year. However, the company’s performance showed a deterioration when looking only at the third quarter itself.

The company, however, showed a net income gain of 63.6% to ¥4.5 billion ($56 million) as compared to a net profit last year of ¥2.7 billion. Ordinary income also showed a small gain of 1.9% year-over-year. However, the company’s performance showed a deterioration when looking only at the third quarter itself.

The restructuring of Yamaha’s domestic sales and marketing units was first announced back in July 2012. However, the company now has decided to make even more extensive changes which will have a bigger cost impact on their finances. As a result of this, the company is forced to recast their projections to account for this greater expense and its negative impact on their FY2013 annual results. The recast forecast, revised in October 2012, projected a net profit of ¥3.5 billion – up from a loss of ¥29.4 billion last year. However, now the new forecast is for the company to just break even as it will now have an extraordinary restructuring charge of ¥3.29 billion – largely for staff severance.

Reasons for revision, by product segment…

The company gave a breakdown of its revision to help explain why it was necessary. According to their announcement, the AV/IT segment is now expected to experience a sales decline and “income is expected to deteriorate due to decreased profitability at the plant level” due to production cutbacks. The electronic devices segment (integrated circuits) is expected to also show a sales and income decline “because sales are expected to fall short of the forecast levels and other factors.” And finally, the “others” segment is also expected to show a sales decline, though no particular explanation was offered.

New internal structure to company…

This new entity will fall under another Yamaha division called Yamaha Music Trading Corporation (YMT) which will be charged with taking over and continuing the wholesaling of musical instruments and audio products, as well as overseeing the company’s music school operations in Japan. This new responsibility will, like the merger described above, take effect April 1, 2013.

As YMT’s responsibilities have been expanded, the Board also decided to fold Yamaha Electronics Marketing Corporation (YEMJ) and Yamaha Music Lease Corporation (YML) into YMT. When those changes are implemented, YMT’s corporate name will be changed to Yamaha Music Japan Co., Ltd. and will become the central company of Yamaha Corporation Group.

Had to do something…

Yamaha said they had to do something…the domestic musical instrument and audio product markets “are now mature.” Accordingly, the company says it must take steps to increase management efficiency “with the aim of strengthening its profitability in business activities in Japan.”

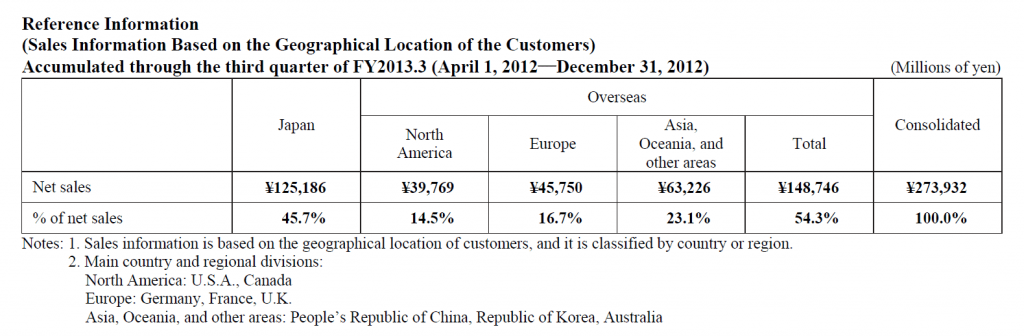

Why such a focus on the Japanese market? Well, simply put, the Japan market is worth almost half of their entire sales volume – actually for the nine months ending December 31, 2012 it was 45.7% of their total revenues. Sales and profit declines there…really hurt!

Leave a Reply