Shizuoka, Japan-based Yamaha Corporation – the world’s largest musical instrument maker that also offers pro, commercial, and residential audio gear is warning markets that the global chip shortage – while improving marginally lately – is still creating challenges that constrict manufacturers’ ability to achieve production goals. It is the first such warning I’ve seen from a company well known for acoustic pianos – but whose electronic instruments and audio gear generate more revenue.

See more of what the Yamaha President had to say about chips

In an appearance on Nikkei CNBC television last week in Japan, Yamaha President Takuya Nakata talked about the current business environment in general. He also specifically discussed the ongoing supply chain issues, especially the semiconductor supply challenges known as the chip shortage.

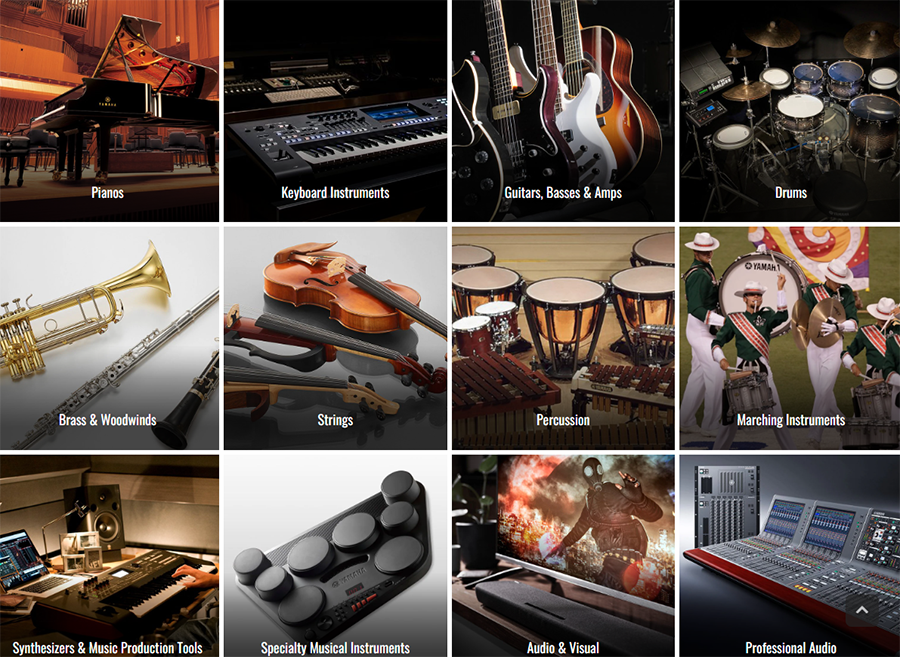

Yamaha is particularly well-positioned to comment on the matter, as it is a large global manufacturer of high-quality acoustic musical instruments, electronic musical instruments, and a wide range of audio gear. While supply chain challenges are a multi-headed monster that has to varying degrees impacted just about every segment of the economy, Yamaha’s President focused on the unique challenges presented to it by the chip shortage.

Supply and Demand are Still Imbalanced

The situation is improving, but there is still an imbalance between supply and demand. Shortages are still continuing. There were about ¥35 billion ($253 million) in opportunity losses in the previous fiscal year. I think we could lose about ¥30 billion this fiscal year as well.

Takuya Nakata, Yamaha Corporation President

Like many businesses, Yamaha actually saw some benefit from the COVID-19 lockdowns around the globe. In fact, it benefitted from a resurgence of interest in musical instruments, as well as increases for its residential audio products, as cooped-up citizens sought to entertain themselves and their families. For example, in musical instruments the company saw piano sales rise 14% year-over-year in the fiscal year that ended in March 2022.

Harder for High-End Audio to Adapt to Supply Chain Issues

President Nakata said that their musical instrument business was able to adapt to supply chain shortages through various design changes. But he adds that this is harder to do for their high-end audio gear, like mixers used in studios and concert halls because they use more components that are harder to replace, according to a report by Nikkei.

“[High-end audio] customers will be concerned with even a slight change in sound, so we need to be very careful,” Nakata said.

Because of this, the global chip shortage continues to be vexing for the company. The Nikkei report says that “Yamaha suffered a double blow due to a fire in 2020 at a factory of Asahi Kasei Microdevices, one of its key chip suppliers.”

New Fabs Built for Cutting-Edge Chips; Audio & Musical Inst Need Less Advanced Chips

Interestingly, the company noted that it is true that semiconductor manufacturers are investing heavily to build new fabrication plants (fabs) to add more production capacity. But, Yamaha notes, they are mostly investing in fabs to produce cutting-edge chip designs for emerging applications. However, audio and musical instruments use less advanced chips, so that means that production for this less advanced grade of chips for audio use may continue to run short for some time to come.

Yamaha’s sales for the recently completed fiscal year rose a solid 9.5% to ¥408 billion ($3.3 billion), thanks in part to a declining yen. However, the Nikkei notes that this level is less than their target sales of ¥470 billion set by Yamaha in a previous three-year plan. In a newly announced three-year plan announced by the company, it has set a target sales level of ¥500 billion by the fiscal year ending in March 2025.

Yamaha’s Business Breakdown

The company’s business breaks down as: musical instruments (67.7% of total), audio (23.7%), and other (8.6%). That means that their total global audio sales are approximately $792 million.

Yamaha’s largest market is Japan, which accounts for 25.8% of their total sales. This is followed by: North America (21.4%), Europe (19.4%), China (16.6%), and Other (16.7%).

Targeted Areas for Growth

Nakata pointed to one “key growth area” for the company – guitars. He says this “is the only instrument in which we are not number one.”

Another area for growth for the company is a deal that Yamaha won to supply audio equipment for Geely, a Chinese manufacturer of electric vehicles.

Learn more about Yamaha by visiting Yamaha.com.

Ted, Not to put too fine a point on things But The only use of Yamaha mixers while excellent products recording studios are similar venues is at a very low level for example personal studios Very few of them to be honest from what I see college or junior college or similar type education facilities with a studio a decent market share I was expect However at the pro recording studio level zero to my knowledge touring and all live sound globally a significant market share Although in going back and looking at various rider info They are not being specified as a level they were 2018 primarily because numerous competitors Took the enforced covid break As a chance to reduce sales and marketing head count But try to hang on to their engineering staffs And use the break to accelerate significantly new product development thus At this point we’ll say the first six months after the covered decline in the US and some places else At least three if not four or five major competitive products Have Been launched into the market from companies like SSL , Midas , Allen and Heath , and especially DiGico , presonus Studio Live new console Usually popular with the users of their software . At the very highest level and big time global or continental touring You will find a very narrow field of accepted suppliers which includes Yamaha certainly but at say B-team levels But the major artist riders Will more often than not request One of the other majors Like digital SSL Midas and several others . I was just Trying to Make a minor correction in your article .

Yes Ted, the supply of older chips is a real problem. I spent over 30 years in the AV industry, but I now represent an American manufacturer of electronics that are critical to public safety, hospitals, manufacturing, education, transportation and other markets. They have a record breaking backlog, billions of dollars in products, sitting in warehouses, waiting for chips. There are severe shortages of older common chips used in our products, autos, appliances, and other electronic devices. It is the basis for the inflation in car prices, (and also used car prices, due to the resulting shortage of new cars), and all other consumer and industrial equipment that need chips. This problem will persist for some time, and fed rate hikes will not have an effect on these major components of inflation.