Yamaha Corporation last week announced a new medium-term management plan titled Yamaha Management Plan 2016 (YMP2016) which sets forth management’s strategies for the time period of fiscal 2014-to-fiscal 2016. The new plan succeeds the previous Yamaha Management Plan 125 (YMP125) which was just completed March 31, 2013.

Yamaha Corporation last week announced a new medium-term management plan titled Yamaha Management Plan 2016 (YMP2016) which sets forth management’s strategies for the time period of fiscal 2014-to-fiscal 2016. The new plan succeeds the previous Yamaha Management Plan 125 (YMP125) which was just completed March 31, 2013.

First task of the new plan? Explain why the previous plan failed…

Yamaha’s previous YMP125 medium-term plan – a plan that covered the three-year span from April 1,2010 through March 31, 2013 – was supposed to position the company for explosive future growth. In fact, the plan’s subtitle was “Build a foundation for growth.” The “125” in that plan’s title referred to a source of great pride for the company, its 125-year history.

However, the company failed to meet most of that plan’s goals, largely as a result of several well-known factors that affected just about every Japanese manufacturer. These factors include, among other things, a sluggish global economy, a negative currency exchange rate, and unforeseen natural disasters in Japan and Asia.

Results against the last plan…

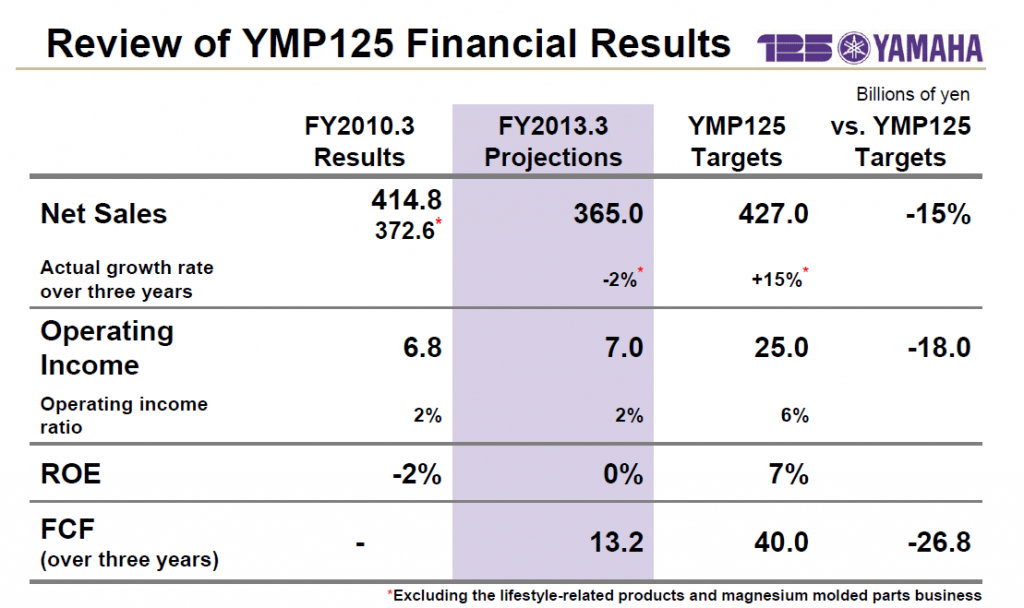

In YMP125, the company had forecast it would grow sales from ¥414.8 billion ($4.2 billion) to ¥427 billion or about 3 percent. However, the company is now projecting that their sales for the year ending March 31, 2013 actually will be about ¥365 billion or 12 percent below the starting level.

The operating income results also missed their mark. The company had forecast that operating income would rise from ¥6.8 billion ($68 million) to ¥25 billion or an amazing 268 percent. However, the company now expects operating income to be ¥7.0 billion for just a 3% increase – well off their original forecast.

The company had listed the follow five key strategies for driving their growth in YMP125:

- Accelerate growth in emerging markets

- Increase market share in developed countries with a series of specific product-centric goals

- Build optimal production structure to meet trends in demand

- Create business models for service and content businesses

- Create new business in Sound Domain

For each of these points, the company had more specific details of their approach. However, their results were decidedly mixed:

- Emerging market growth: The company broke down their results by tracking China independent of other emerging markets. For China, Yamaha actually exceeded their goal which was to grow their business from ¥16.3 billion to ¥24.5 billion or 50 percent. The final number for China actually came in at ¥24.9 billion – 2 percent over their goal. However, the other emerging markets – while growing from ¥48 billion to ¥52.2 billion – failed to achieve their YMP125 goal of ¥59 billion.

- Increased market share in developed countries through specific product-centric goals: The company broke this strategy down into five specific product goals with target sales numbers that were titled – total piano strategy…combo strategy…PA equipment…and AV Products. Not a single one of these goals were met and one – AV Product sales – not only failed to achieve its target YMP125 growth number…it actually saw its sales decline from ¥46.2 billion at the beginning of the plan to ¥41.7 at the end of this March.

- Build optimal production structure: There was better news for Yamaha on this goal. The goal for the restructuring was to achieve specific cost reduction target numbers. In the case of wind instrument production, the company hit its goal of ¥0.5 billion in cost savings. And in the case of piano production restructuring, the company actually realized cost savings of ¥1 billion, as compared to their goal of ¥.05 billion in cost savings.

- New service and content businesses: In the case of creating new service and content businesses, the company had two major initiatives – create a music playing business…and create a music entertainment content business. One of these involved offering music lessons and the other involved offering music content for smartphones. For various reasons, both of these initiatives failed to make a contribution to the company’s results.

- Create new business in the Sound Domain: Yamaha had envisioned creating what they call an environmental acoustics business for certain vertical markets. The division was in fact created – “but made only a limited contribution to sales figures.”

In summing up their results, Yamaha admitted that: 1) “Results were well below target, due to inability to cope with higher-than-anticipated appreciation of the yen;” 2) “As markets recovered from East Japan earthquake and Thai flood damage, actual sales deviated sharply from projected sales, and lower production due to rising inventories had a major impact on business;” and 3) “New business creation made a limited contribution to overall results.”

In summing up their results, Yamaha admitted that: 1) “Results were well below target, due to inability to cope with higher-than-anticipated appreciation of the yen;” 2) “As markets recovered from East Japan earthquake and Thai flood damage, actual sales deviated sharply from projected sales, and lower production due to rising inventories had a major impact on business;” and 3) “New business creation made a limited contribution to overall results.”

Still, there were successes as well: 1) “China, a key element in the business strategy, achieved targeted level of growth;” 2) “As Yamaha marked its 125th anniversary, Yamaha expanded its market presence by launching of industry-leading products including grand and hybrid pianos, electric acoustic guitars, small guitar amplifiers, mid-range digital mixers, and AV receivers;” and 3) “Consolidation of piano and wind instrument production in Japan was completed according to plan.”

The plan is dead…long live the plan…

Out with the old and in with the new. Yamaha management is boldly putting forth an all-new YMP2016 plan for the next three years based on where the industry is at now…and based on the opportunities they perceive for further company growth.

As imperfect as YMP125 was, management continues to view it as the period where the foundation for growth was set in place. Accordingly, the company has boldly declared that YMP2016 will be its “quantum leap phase.”

The company’s “Management Vision” is three-fold:

- Becoming a brand that is trusted and admired

- Conducting operations centered on sound and music

- Achieving growth driven by both products and services

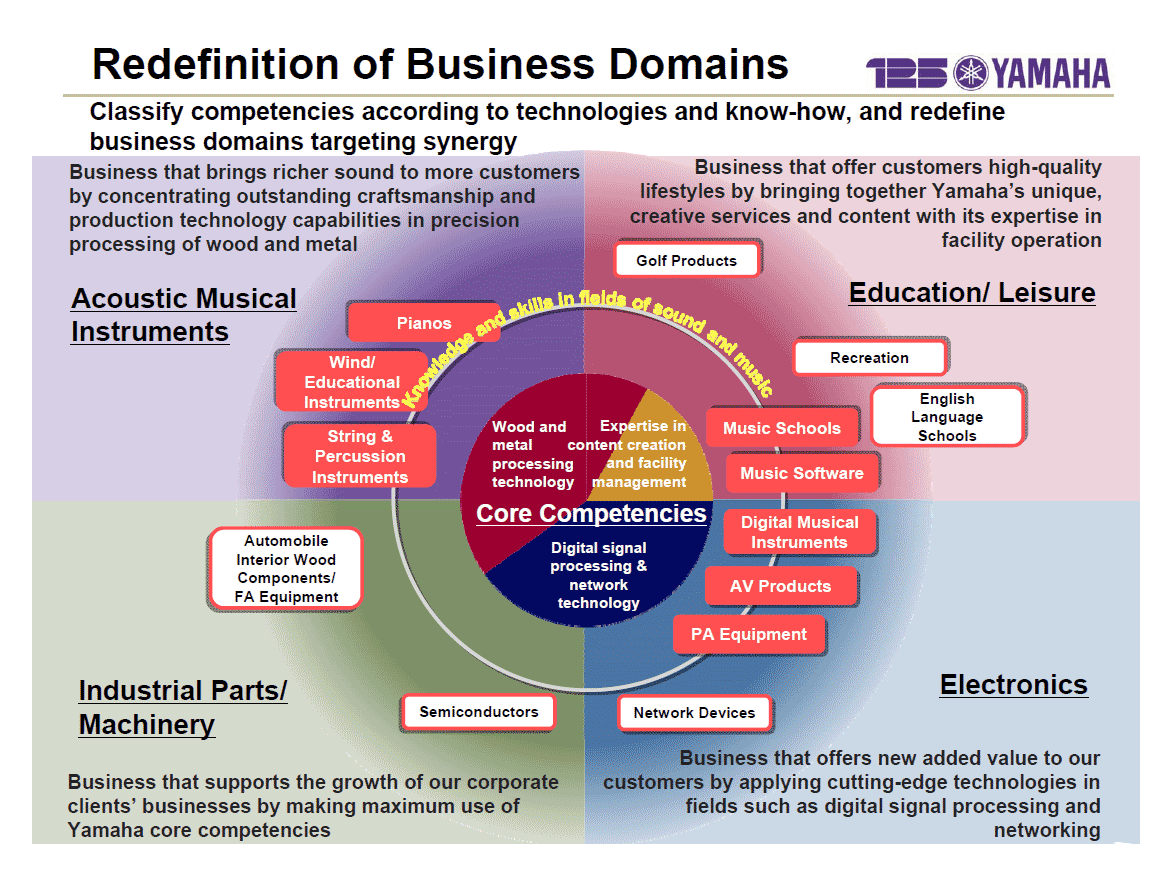

According to the company, management has recast the scope of operations into four “business domains:” 1) Acoustic musical instruments; 2) Electronics (primarily digital signal processing and networking); 3) Education/Leisure; 4) Industrial parts/machinery.

For this new plan, management has set three “basic policies” or overarching goals. These goals are: attain sustainable growth…strengthen profitability to support growth…and enhance specialization and professionalism to create new value added.

First and foremost…

First and foremost…at the onset of the plan…step one is to achieve “steady growth in existing businesses” and to engage in “active investments for growth aiming for the next leaps forward.” In fact, the company fully expects that it will actively seek and invest in outside companies in search of new growth opportunities. This is a concept not normally held by Japanese “not-invented-here” companies.

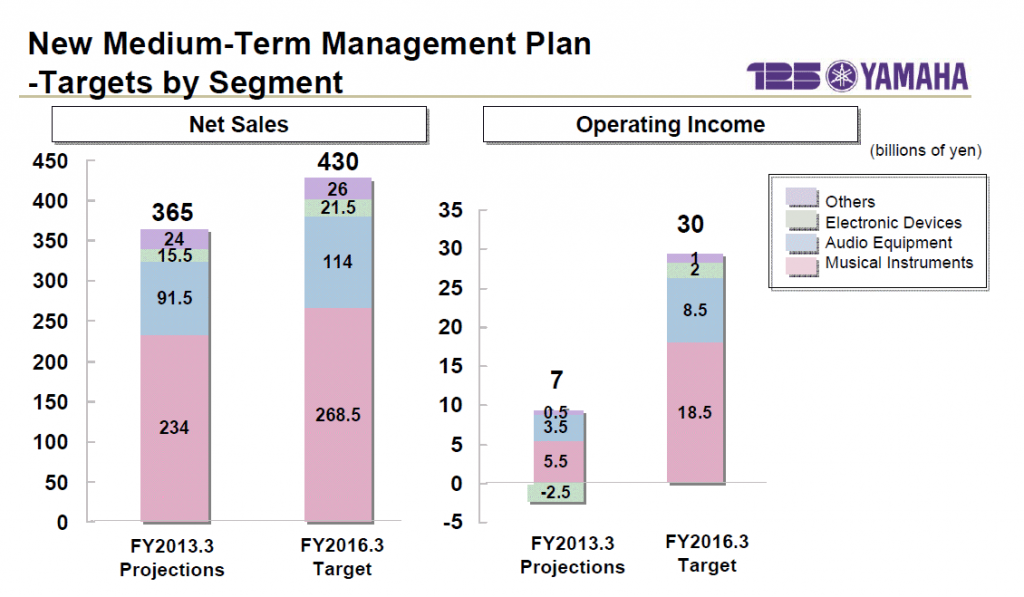

The company has set the following new numerical targets to be achieved by March 31, 2016:

- Sales: ¥430 billion. This is 18 percent over current year. (14 percent considering expected currency changes)

- Operating income: ¥30 billion. This is 328 percent more than the current year.

- ROE (return on equity): 10 percent. ROE in the current year is 0.0 percent.

Yamaha’s key strategies to achieve these new goals:

- Accelerate growth in China and other emerging markets – Having already achieved some success in these markets, Yamaha fully believes that it has room-to-run in emerging markets. The company launched operations in Vietnam, a new market for them, the first of this month. Yamaha also opened a new sales subsidiary in Turkey and a “representative office” in South Africa. South Africa is the first step in growing the southern portion of the African continent.

- Expand sales in the electronics business – Yamaha envisions several initiatives that can enhance growth in the electronics domain. For example, it is creating new more realistic sound sources for its digital pianos and portable keyboards which will differentiate its products. The company will also develop entry-level models (for emerging markets) and enter the low-priced market segments (everywhere).In the professional audio business, the company will broaden its assortment of system equipment with digital networks as their core. The company will also enter the commercial installation market and the professional production market.Finally, the company plans on focusing on the SOHO (small office/home office) markets with products such as routers and USB microphones and speakers for web conferencing.

- Strengthen cost-competitiveness – Yamaha management says it still has opportunities to squeeze greater efficiencies out of its existing production facilities through managing production capacity and utilization rates to lower costs. The company says it can cut costs at its overseas facilities by locally procuring materials and bring some outsourced parts in-house. Finally, it says it will create “new production methods” and “improving existing processes” to lower costs.

- Create new businesses – Interestingly, Yamaha says that to achieve a true quantum leap in its business, it must look outside the company. Therefore, it intends to engage in a serious pursuit of M&A (mergers & acquisitions) and capital partnership initiative. They will especially focus their search for potential partners in the professional audio equipment business where they believe there is growth potential. Yamaha will also invest in venture capital firms so that it can “discover next-generation technologies and services from outside” the company.How serious are they about these initiatives? Apparently, very serious. Yamaha will earmark ¥30 billion for M&A and capital partnerships. They will set aside another ¥3 billion to invest in venture capital companies.

- Human resource development initiatives – Yamaha will step up their educational and training initiatives to help ensure they have fully capable managers to drive these initiatives.

The plans from Yamaha suggest optimism, but one can also sense a connection to reality by a management who has seen their efforts impacted by unforeseen forces or uncontrollable influences. This was what happened in the case of the unachieved YMP125 plan.

Still we found it intriguing that the company is openly pursuing acquisitions and investing in venture capital companies. These type of activities are, of course, common with U.S. companies. But they are significantly less common in Japan.

See more about Yamaha at: usa.yamaha.com.

Leave a Reply